Monthly Archives: March 2021

Why is the ATO suddenly asking you for money?

If you want someone to pay you then it is a good idea to send them a bill so they can. Seems like common sense – but not to the ATO.

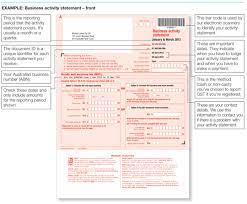

A number of clients have been surprised, offended and/or doubtful of recent payment requests from the ATO. This happened as the ATO elected to cease sending paper activity statements. It seems as though many did not receive a reminder through their MyGov account – or if they did, ignored it legitimately thinking it was a scam.

So will you get into trouble?

The answer is no.

We understand that the ATO will revert to issuing paper statements.

We do though recommend periodically checking your MyGov account just in case you have missed something. Once you have opened a My Gov account, they will no longer issue you with a physical assessment notice; even we aren’t issued with one. They also cease issuing super S293 notices and the like.

But never click on a link within a MyGov email as it may well be a hoax. Log in separately from your internet browser.

Why getting your FBT exposure right is so critical

So why getting your FBT exposure right so critical?

Before we answer that question, I will answer the base question of what is a fringe benefit. A fringe benefit is anything provided by an employer to an employee other than by wage/salary and super.

As such it includes such things as:-

-

Passenger cars

- Car parking

-

Entertainment

-

Selling firm’s goods at a discount

-

Providing accommodation

-

Paying any employee bill whether that be school fees, mortgage, health club membership and so on.

And this leads to the understanding of how to address your FBT exposure which can be summarised as:-

-

Determine whether you the employer are exempt (charities, public hospitals) or subject to a reduced rate (private schools).

-

Determine what fringe benefits you have provided to whom

-

Assess whether an exemption or concession applies to that type of benefit. There are some special rules which benefit small businesses.

-

Calculate the taxable value

-

Then, and this what most people get wrong, determine whether the employee is better off making a contribution to reduce the fringe benefit rather than pay FBT tax (which is equivalent to the highest marginal tax rate).

-

Prepare and lodge the FBT Tax Return.

The reality is that all too many employers get this wrong as the ATO is successful in making an adjustment in 50% of FBT audits. That’s every second audit!

And don’t think the ATO doesn’t think this is a big audit target. One recent project was their recording the number plates of all utes parked at an AFL game at the MCG. Those plate numbers registered to companies were then cross matched with lodged FBT and Income Tax Returns. The ATO had a field day.

So what should you do?

Well for our clients we run through a checklist to make sure all benefit s provided are identified. We will then work through (a) quantifying the benefit before (b) determining the most efficient manner of dealing with the benefit and then (c) lodge an FBT Return (we do this even if the taxable value has been reduced to nil as the ATO have therefore issued an assessment and then only have two years to audit.

And with that I return to the question of why is getting your FBT exposure right is so critical? As you will now be able to appreciate there is more than answer to this question:-

-

It is a key ATO audit area.

-

If it is wrong in one year, the ATO will start auditing all years.

-

With the FBT tax rate being the equivalent of the highest marginal tax rate, the tax can be significant.

-

The ATO readily applies both interest and penalties.

-

The audit clock will start clicking once an FBT Tax Return sis lodged – after that the ATO can’ t go back further than 2 years.

Do you have any questions? We would welcome the opportunity to discuss them with you.

JobKeeper reminder & reality check

We will start with an important reminder to meet your turnover reporting obligation in order to receive your February JobKeeper entitlement by this coming Friday. This means you have to report the actual GST turnover for the month of February and what you think it will be for March.

And with JobKeeper due to conclude with the fortnight ending 28th March, this is the second last time you or your accountant will need to complete this task.

The bigger issue though on the horizon is what happens when JobKeeper ends?

Whilst the drop in the unemployment rate and growth in the GDP rate have been welcome, come April small businesses will be on their own. There is no (as yet but will there be?) targeted assistance to those industries decimated by covid.

So the four biggest questions you face are?

-

How will your business survive?

-

How will the businesses of your customers and suppliers survive?

-

And have you, your customers and suppliers addressed the impact of the end of rental relief? And not only may you soon be paying full rent, what about the portion of relief that was deferred?

-

And are your financiers going to continue to support you?

And with cash flow being the life blood of any business you need to understand what the impact starting in as soon as 3 weeks. Some accounting software providers market their cash flow capabilities, but it is very simple and for the immediate short term.

We however have advanced software which can:-

-

Model out various post 28th March scenarios.

-

Show the cash flow peaks and troughs in the months ahead.

And with our many years of collective experience of working with all sorts of industries, we are able to provide recommendations as to how to rectify and improve what is predicted to unfold.

Our first meeting with clients is free of cost or obligation and we welcome your call.