Managing your team at their homes

We seemed destined to shortly be working from home.

And with that comes new challenges.

Some will be challenging, some will be new, others you may not have thought of.

Warren Howard is both a client and trusted support service. Warren and his team at Howardco specialises in recruitment, HR development and executive coaching.

Warren has kindly allowed me to post his blog on the challenges of managing a team that is working remotely from their own homes.

https://howardco.com.au/blog/working-from-home-were-in-this-together/

I can highly recommend Howardco to you. Unfortunately the first need for many may to handle standing down or terminating team members. Terminating an employee is stressful and unpleasant. Warren is highly skilled in managing the process and making it as seamless as can be.

Commercial rent relief

The federal cabinet is meeting at 10 to discuss measures to provide relief to commercial rent relief to tenants and landlords.

It was flagged by Prime Minister Morrison at the end of his Tuesday night TV press conference.

Whilst commercial rent relief is urgently required, it will be difficult to roll out quickly. It’s one thing to pay pensioners $750 – they are in a data base with all their bank details. It is not more than a pay run. Commercial leases are quite a different beast. There is no central register. They have to be found/report/register. The there is the question of what does each tenant pay.

And there are other issues as well.

Will there be a threshold based of amount of a business’s turnover, rent, area or staff number? Will there be a bias to retail?

We will keep you posted.

In the meantime, please contact us is you have any query in relation to this or any other COVID-19 related matter. And keep coming back to the web page as we will be blogging news, videos and strategies at least twice daily.

How to stay fit & healthy when forced to stay at home (PART 1)

It appears at the time of blogging that it is a now a question of when, not if we go into lockdown.

And with that come new experiences and challenges.

Like staying fit and healthy.

A friend of mine Pete Sleight runs a Vision Personal Training studio in South Caulfield.

Peter has two ways of helping you and says that:-

If your fitness centre has closed and you are feeling a little lost when it comes to your health and well-being, then we have the experience and tools in place to help you stay on track towards your fitness goals.

The ‘HOW‘ may have changed, but the ‘WHY‘ remains the same.

Our community is more connected than ever with Online 1:1 Personal Training Sessions and Online Group Training now available. That’s right, no need to come to us, we will come to you via your mobile, tablet or computer making it never more easier as to WHY you started in the first place.

Stay on track and get in touch with Peter at Vision Personal Training Caulfield to book your free online health and fitness consultation.

I can highly recommend Peter to you and trust this helps many of you to stay fit and healthy.

Peter Sleight

Vision Personal Training Caulfield

Telephone: 04111 77468

Email: psleight@visionpt.com.au

Website: www.visionpt.com.au/studios/caulfield

Tax-free “payments” to employers

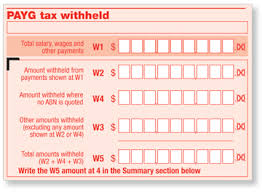

The main plank to the first and second government stimulus packages has been the announcement of tax-free payments to employers.

It is been incorrectly reported as a payment to employers.

However, there will not be a payment in all cases.

It will be either:-

-

Larger employers will not pay the first $50,000 of PAYG Withholding in respect of the months January to June inclusive (they can also benefit in the first half of 2020/21 but we will cover that in a future blog).

-

Employers who withhold less than $10,000 of PAYG Withholding per year, they will receive a minimum credit of $10,000. If that $10,000 is greater than the other BAS liabilities, then the balance will be paid to the employer.

For those that report PAYG Withholding monthly, they can claim the credit for January and February on the March BAS.

The ATO best describes this as a Cash Flow Boost.

Employers will still be allowed to claim all of the PAYG Withholding as a tax deduction – even though it is not paid.

Employees will still be allowed to claim a tax refund for all of the PAYG Withholding reported – even though the employer has not paid some or all of it.

The ATO has stated that they will pay refunds within 14 days.

Please come back to read updates on how you can benefit from this concession. We also welcome any question you may have.

Tips to stay positive in the face of COVID-19

We are doing all we can to help our clients. With this in mind, we publish below a series of tips to stay positive in the face of COVID-19.

We give thanks to the UK’s James Ashby who has allowed this document to be openly shared.

COVID-19 matters

We are sorry to have not posted over recent weeks.

In the face of various COVID-19 matters, we have been flat out:-

-

Helping our clients with their challenges,

-

Creating a Business Continuity Plan and support program,

-

Creating and delivering Friday’s business survival webinar,

-

Undertaking necessary precautions internally, and

-

Preparing ourselves for a possible office closure.

We can now return to providing more regular blogs and if you aren’t an existing client, welcome the opportunity to assist you to be informed and in control in these volatile and uncertain times.

Are your staff going to work from home?

COVID-19 has changed the way we work. Are your staff going to work from home? Or are they already working from home?

If so, then there are number of things to consider.

All employers handle Tax File Number of their employees. Employers are therefore subject to the provisions of the Privacy Act irrespective of their turnover. It is beyond the scope of this article to address how you comply with the Privacy Act so we will just address the issue of a breach. Should there be a privacy breach due to the mishandling of sensitive personal information, it of course must be addressed, be reported to the Privacy Commission and a public statement made. This could be embarrassing to say the least! And costly.

The question therefore arises is how secure is your employee access to your data. You might have all the security in the world employed in the office. But that means nothing if someone logs in to your server from an insecure home computer with no up to date virus and malware protection. They may also have an insecure internet connection.

These are a number of other matters to consider. We have a client Business Continuity Plan which addresses this and many other matters. Please ask us if you would like a copy.

With such risks, it is in our opinion essential to have cyber insurance. Please ask us if you require a referral to an insurance broker who can make sure you get the right cover.

We are also happy to recommend a trusted IT professional to assess your needs.

SG amnesty – prior reported breaches

An employer who is late in paying their super must pay it to the ATO on an SG Super Charge Statement.

An admin charge and lost earnings component are added to the amount payable. Worse still, the total amount paid is not tax deductible. As we always say super liabilities are the liabilities you pay first.

Last week the SG Amnesty laws were passed by Parliament. This amnesty allows employers to report and pay any underpaid super and do so without the usual penalties.

What it also enables is those that have previously lodged a SG Super Charge Statement to seek a refund.

We welcome the opportunity to assist you with this and will provide guidance once we have been trained on the amnesty.

SG super amnesty

The Senate passed the SG super amnesty bill last week. All that is required now is for it to receive royal asset after which it becomes operational law; that process usually only takes a few days.

This amnesty allows employers to come forward and declare underpaid SG super and do so without the normal (hefty) penalties.

It has been quite a political journey to finally get to this stage. The bill was first introduced into Parliament two years ago. It never received support and lapsed with last year’s election.

We are pleased that it has been passed as we believe many employees will benefit. Whilst we are abhorred and disgusted by those employers who don’t pay any of their compulsory super obligation, there are many cases where innocent oversights have resulted in relatively minor under payments. This amnesty should see a considerable amount of super paid to the benefit of employees.

Full details of this amnesty have yet to be explored and analysed. We await training on this and look forward to explaining more in due course.

We strongly encourage all employers to not miss this opportunity.

All employers should review their level of compliance since 1992. Why 1992? Well the system was introduced in July 1992 and the ATO can go back audit any period they like. And one thing about an amnesty; once they are over, the ATO comes out with baseball bats.

We welcome any question you may have but look forward to explaining more shortly.

ATO focusing in on investment strategies

The ATO is focusing in on investment strategies.

Last September they wrote to, and scared the life out of, 17,700 self managed super fund (SMSF) trustees.

Last week they released their guidelines. We will explain their approach and demands as we study these guidelines.

We will also be in discussion with our SMSF auditor.

We do not believe any major shift will be applied retrospectively.