Are you a share trader or share investor?

Are you a share trader or share investor?

It’s an important distinction as it can make a world of difference.

Both declare dividends as income (with a tax credit for any imputation/franking credits). However:-

- A share investor is assessed on realised gains (i.e. when a share is sold). Only 50% of the gain is assessed if the share is held for more than 12 months. No deduction is available for realised losses; they can only be offset against capital gains.

- A share trader is assessed on both realised and unrealised gains (and losses). The cost of shares bought are deducted as purchases, the sales treated as income and the value of shares at 30th June is treated as closing stock (and therefore income).

So are you a share trader?

Well that depends on matter such as:-

- The amount invested.

- The frequency of trades.

- The amount of trades.

- Whether it is being carried on in a business like manner. In this regard, the ATO always places great weight on the existence of a business plan.

- Time and money spent on research.

- The sophistication of the operation including software programs.

It must also be said that the ATO take particular interest in taxpayers who change from one status to the other. Particularly so in years where there are large market movements.

Not sure where you sit?

The ATO has a useful short summary at – click here

We would your call to discuss your situation at greater length with you.

National Scam Awareness Week

No doubt you have heard through multiple channels that it is National Scam Awareness Week.

Some of the stories that have come out this week have been frightening. Perhaps the most alarming one was that the Commonwealth Bank stated that they are pulling down 50 fake web sites a week!

One must be vigilant and rely on common sense. If your employer, should be running training and moreover have the best security software. We have just ramped up our security and would welcome introducing you to an IT specialist.

Here are some scary facts – losses year to date from various forms of scams have been:-

- $94,120,506 from investment scams

- $13,399,355 from romance scams

- $10,126,156 from phishing scams

But I suspect the real number is much higher as many would be too embarrassed to report their loss. and rarely can it be undone.

The three most common scam contact methods are:-

- Text message – 62,121

- Email – 51,023

- Phone call – 26,804

There are many things I could say but perhaps the best 4 tips I can give are:-

- Never click on a link from a text or email; always log in from your normal log in page.

- Never respond to a request for personal information.

- Use two factor authentication.

- Have an IT specialist make sure your security is state of art and up to date.

You can read more at the National Anti-Scam Centre – https://www.nasc.gov.au/

How can I claim car travel?

In order to claim car travel in your personal Tax Return:-

- You (or your partner) must own the car.

- You must have undertaken a trip for either your business or your employer.

You can claim under two methods:-

- Log book, or

- Cents per kilometre

Tip

You can use a log book kept for three months in the current year or in the last four years (provided the pattern of travel hasn’t changed significantly).

Tip

You must have a properly kept log book. You can do so by buying one in a stationers or you can access an electronic one form our firms app.

Tip

As old school as it may seem, it is best to keep a paper log book.

Throw it on the dash so you can see it when you get in the car (and get out).

I can’t tell you the number of times a client has told me they started an app log book but kept forgetting to record trips. End result? Either have to revert to a lower cents per km claim (see below) or endured the frustration of having to start a new log.

Tip

If you are wanting to claim under the log book method, you will need to keep other records other than the look book. Click here to see the required documents.

Tip

You can claim 88 cents per kilometre under the cents per kilometre method for up to 5,000 work/business strips. This means you can still claim 5,000 km where you travel say 5,500km. Some people choose to do so as it gives them a better claim than under a log book. All you need is a reliable estimate of all trips undertaken during the year.

Want to know what works best for you

Call us. We even have a salary sacrifice calculator so we work out the best way to package up a work car and legally minimise the Fringe Benefits Tax.

What is the depreciation limit?

What is the depreciation limit is a very good question as it has unclear for too long.

It was all clear after 30th June 2023 that the instant asset write-off provisions for small businesses had ended. It was great whilst it lasted (but noting the flip side that the proceeds from selling car fully written off are now fully assessable).

The depreciation limit for 2023/24 was up in the air for far too long. Unfortunately the proposed amendment of a $30,000 limit was not passed. So the depreciation limit for 2023/24 is $20,000 – to read about tips and traps about the $20,000 limit, please refer to our earlier blog at – https://www.mrsaccountants.com.au/asset-depreciation-claims-for-2023-24/

So what is the depreciation limit for 2024/25?

$20,000.

Who can claim these depreciation rates?

These limits are available to businesses (whether operated via a company, trust or partnership or as a sole trader in one’s own name).

The $20,000 limit also applies to an opening pool

Small businesses who have elected to use the pooling depreciation system with its high depreciation rate can also claim the pool balance when it falls below $20,000. That is defined as being:-

- The opening balance of the pool

- Plus the taxable portion of acquired assets

- Less the taxable portion of assets sold during the year.

So if your business bought an asset costing say $22,000 ex GST in 2023/24, then the opening balance of $18,700 can be written off in full in 2024/25 (assuming no other assets acquired or disposed of).

It is beyond the scope of this article to run through all the rules but please keep in mind that you can only claim depreciation from when an asset is installed and ready for use.

Please don’t hesitate to contact us if you have a query.

Can I deduct the cost of charging my electric vehicle?

This has become a common tax question. And the answer is it depends whether you can deduct the cost of charging your electric vehicle.

No claim is available if you claim work car expenses under the cents per kilometre method. That is because the per kilometre rate takes into account charging costs.

Electric charging costs can be claimed at the rate of 4.20 cents pkm where:-

- Claiming car expenses under the log book method.

- Motor vehicle expenses for vehicles that are not a car (such as a one-tonne ute).

To qualify to use this rate you must satisfy the following three conditions:-

- The car or vehicle is a zero emissions vehicle. It is important to note that hybrid vehicles are not zero emission vehicles.

- You must have incurred electricity costs at home.

- You have kept relevant records.

There are 3 relevant records to keep:-

- A valid log book.

- Opening and closing odometer readings.

- An electricity bill (with proof of obligation to pay if in a shared house).

What if I charge my vehicle out of home?

Thankfully the ATO have dropped their initial harsh stance of not allowing such claims.

To be able to claim such costs, the vehicle must have functionality that accurately reports the percentage of a vehicle’s total charge based on the charging location. One is then to adjust the home charging percentage adjusted accordingly.

If your electric vehicle doesn’t identify charging by location then one can only claim either:-

- The home charge at 4.2 cents pkm or

- Commercial charging charge costs.

But not both.

We hope this charges up your tax claim – but please contact us if you have any queries.

Correctly claiming your home office expenses

With the start of a new financial year it is timely to explore how to correctly claiming your home office expenses.

Can I claim home office expenses?

Yes you can if:-

- You are undertaking genuine employment related activities, or

- Home is your sole base of operations (which includes employees who are not provided with an office, or

- You are carrying on a business from home.

What can home office expenses can I claim?

You can claiming running costs such as:-

- Heat, light and power

- Phone expenses

- Internet

- Consumables such as computer supplies and printing & stationery items

Those who run a business from home or it is their sole base of operations can also claim occupancy costs.

How can I quantify my claim?

There are two available methods:-

- Fixed rate method

- Actual expenses

How does the fixed rate method work?

Under this method, one claims 67 cents for every hour worked at home. Occasionally checking emails doesn’t is not sufficient to allow a claim.

To qualify to sue this method you must incur at least one of the following expenses:-

- Electricity or gas for heating and/or cooling or to power equipment.

- Internet

- Mobile or home phone

- Printing and stationery.

Receipts must be kept to evidence one or more of these costs have been incurred.

And additional to this claim is the depreciation of any home office work items.

TRAP Irrespective of how much you may genuinely use your mobile away from your home office, you will not be able to make a separate claim for using that mobile.

TIP You don’t need to have a set aside office only used for work purposes. You just need a dedicated area.

TIP Once can also claim for hours worked at a holiday home (provided above criteria satisfied).

What records do I need to keep under the cents per hour method?

In addition to the receipts above, as we have highlighted in past posts and Tax Return covering letters, you have been required since February 2023 to log every hour worked at home.

TIP As stated above, you can only claim hours you have logged. You can download a spreadsheet below that is set to track very hour worked at home.

TIP We recommend downloading the spreadsheet below and saving it in the middle of your desktop or laptop – that way you won’t forget to log the hours as you work them.

You can download the home office cents per hour method by clicking here – 2024-25-Home-Office-Expenses-hours-worked-log

What is included within an occupancy home office expenses claim?

One first measures and calculates the area that is used for work/business purposes.

The work/business area % is then applied to:-

- Heat, light and power costs.

- Rent paid

- Mortgage interest

- Council & water rates

- Insurance

However, the area that is claimed under this method means that the Capital Gains tax Principal Residence is lost on the claimed area for the years claimed.

Please call us if you wish to discuss your claim in greater details.

Asset depreciation claims for 2023/24

You don’t know depreciation limits for 2023/24? I don’t blame you for it is not at all clear.

The instant asset write-off brought in during covid was in place until 30th June 2023.

You may have heard that in last month’s Federal Budget, the limit was to be increased from $1,000 to $20,000 for next financial year. But that hasn’t been passed into law yet.

It was announced in last year’s Federal Budget that the limit for 2023/24 was to be $20,000. Only problem is that hasn’t been passed into law yet either! But there is some good news behind that. An amendment has been brought forward to lift the limit for this financial year to $30,000. If only they would pass the bill!

TIP The $20,000 limit (or is that $30,000?) is the ex GST amount.

TRAP being an ex GST amount, beware of buying a car costing say $20,900 (assuming only a $20,000 limit is passed into law) bought privately. Being private there will be no GST so the GST exclusive price is over the limit.

Should I buy an asset I need costing more than $20,000 before July?

Yes – Assets costing more than $20,000 result in a15% depreciation claim even if bought on the last few days of the year. Depreciation claimed in subsequent years will then be 30% of the reduced balance.

So if you by a $30,000 asset on 28th June, your business can claim $4,500 of depreciation in 2023/24 and then $7,650 in 2024/25.

If buy the same asset on 3rd July, your business will have no claim for this 2023/24 year and only $4,500 in 2024/25.

Only buy assets you need!

Depreciation is like any other expense – it’s a deduction which reduces your tax. But if your business is a company then at the 25% small business tax rate, you will save $7,500 in tax over the years. Which means you will have paid the other $22,500.

How should I finance an asset or pay for it?

It depends.

Depreciation (allocating cost over a number of years) reflects that an asset is used to produce income over many years. So it is often appropriate to seek finance to fund the purchase and match your cash flow to the use of the asset.

That said, some assets are hard to finance. Computers lose value as soon as they are bought and lack re-sale value. Consequently, the interest rates are high. And the same is true for unusual assets that are hard to re-sale.

It should also be said that gone are the many welcome years where the interest rates on car finance agreements and the like were historically low. For some with excess cash reserves, paying cash may be the more suitable option.

What form of finance should I use?

Well that depends on your circumstances.

But please be mindful that under a lease you are not the owner until you pay out the residual value. As such you are not the owner until the contract comes to an end. This means your deduction is lease payments (and which will be the same as the first year as the last year). Which means that you are not claiming depreciation and interest (in which case your claim is higher in the first year than the last year).

What if my business buys multiple numbers of the same asset?

That is OK as assets are not grouped. So as long as each asset costs less than $20,000 (or is that $30,000?) then 5, 10 or more of the same assets can be deducted.

What if I am an employee and not a business?

Then you can only deduct in full the cost of assets costing less than $300 (including GST). Anything costing more than that must be depreciated.

Want to know what is best for you? Then call us – we welcome your call as we love helping small business owners.

Can you benefit from catch-up super contributions?

It’s that time of year when people are looking for tax deductions. The relatively new catch-up concessional contribution system may be ideal for some.

Long gone are the days when contributions of more than $100,000 could be made into super.

And now that the deducible contribution limit is just $27,500 it just doesn’t leave much to fund for retirement after taking out 15% contribution tax and life insurance premiums. And this low limit becomes more of problem if one doesn’t use their limit in any year(s).

This low limit particularly hurts those who leave the workforce to bring up children. The same can also be said for those who have a couple of tough years financially. This is particularly true of many Victorian business owners during covid and beyond.

The catch up concessional system allows some to contribute more than the $27,500 limit for which a tax deduction can be claimed for the full amount.

To qualify to make a catch-up concessional contribution before 30th June 2024 one must:-

- Have less than $500,000 in super as at 30th June 2023.

- Not used all of one’s limit in any year from 2018/19 to 2022/23.

- Must qualify to be able to make a contribution.

This year is particularly important as it is the first year an unused year will drop off. That is, if you didn’t have concessional contributions of $25,000 accepted by your super fund(s) in the 2018/19 year, that shortfall will be lost if not used by the end of this month.

Things to be wary or mindful of:-

- Some super funds cease accepting contributions by Monday 24th

- The 30th June falls on a Sunday. Those with their own self managed super fund need to avoid making a contribution (banking transfer) after cut off time on Friday 28th June as it will be treated as a contribution in July. That is next financial year.

- And that problem becomes doubly worse if you are not able to make a contribution in July 2024.

- A contribution may not suit you from a tax perspective this year as your income may be too low.

- Or perhaps it is a good year to trigger a capital gain.

- Those with incomes over $250,000 need to be mindful of the extra 15% tax on contributions (and be mindful of how Section 293 income is defined).

- A catch-up concessional contribution cannot be accessed one satisfies what is called a “condition of release” is satisfied (with the main one becoming retired).

So there are many factors to take into consideration.

Whether you should or shouldn’t make a catch up concessional contribution is best done by receiving personal financial planning advice. Such personal advice will address your current situation and future goals and needs. Please let us know if you would like a referral.

2024 super co-contribution

Under the super co-contribution scheme, the government will contribute $1 for every $2 of personal contributions made by an employed or self employed person.

The maximum government co-contribution is $500. So if you wish to target the full $500, you will need to contribute $1,000.

To be qualify, one must:-

- Be employed with their employer paying the compulsory SGC or be a self employed person running a business.

- Have 10% or more of one’s income coming from employment and/or a sole trader business.

- Be less than 71 at the end of the financial year.

- Have combined assessable income (that being income before deductions), Reportable Fringe Benefits (RFBA) and employer super contributions in excess of basic SGC amount (RESC) of less than $60,400.

- Have paid a non-deductible contribution into superannuation from after tax money by 30thJune 2024. This means the contribution must be made from a personal or joint bank account.

- Not be a temporary visa holder.

- Lodge a Tax Return for the year ending 30thJune 2024.

- The maximum co-contribution for a personal contribution of $1,000 is $500 if your combined assessable income is under $45,400. Thereafter it progressively reduces by 3.333 cents for every dollar in excess of $45,400. There is no entitlement if your combined assessable income exceeds $60,400.

- Not have contributed more than your non-concessional cap.

- Have a total super balance under the Transfer Balance Cap (between $1,800,000 and $1,900,000).

If you want to find out what you might be entitled to, click on the following link to the ATO’s calculator here

Other matters to note are:-

- One’s own contribution and that made by the government will be preserved. That is, one will not be able to access it until one retires or satisfies another condition of release.

- The ATO will deposit the co-contribution into one’s super account once they have reconciled one’s lodged 2024 Tax Return with the information provided by one’s super fund(s). Consequently, most co-contributions will not be credited until at least January 2025.

- If your super is with a public or employer superannuation fund, you will need to ensure they accept such contributions. You also need to obtain the appropriate form.

- You will need to make your contribution well before 28th June (as 30th June falls on a Sunday). For those with your own SMSF, your fund can only accept such a contribution if permitted by its trust deed. We will take no responsibility where a client does not consult with us beforehand.

What is best for you depends on your circumstances and take into account a large number of considerations.

You should therefore seek financial planning advice to ensure such a contribution will work as intended and is in your best overall interests.

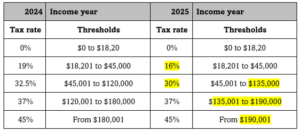

Tips and traps in the 2024 Federal Budget

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|