SMSF investment strategies

Last month, the ATO wrote to 17,700 self managed super funds (SMSFs) trustees and threatened fines of up to $4,200. The letters were sent to trustees where their SMSF had more than 90% of its assets in one asset class.

It has now come to light that the vast majority of those letters went to those funds where property was the main asset and there was a limited recourse borrowing arrangement (permissible borrowing with super).

The point remains though there is nothing wrong with borrowing nor buying a property within a SMSF. Both are permissible (as long as all relevant requirements are satisfied).

This includes documenting your decisions to do so within an Investment Strategy.

The only thing that appears to have changed is that the ATO has now re-defined a 23 year old requirement and are now expecting trustees to document the decision why you have decided to do so.

Accountants can’t advise on where you should invest your super (they can only provide a template for you to fill in and complete). If you need assistance with the process and/or want to know the long term ramifications of your strategy (and options) then you should speak to a financial planner.

When can I claim a bad debt as a tax deduction?

When can I claim a bad debt as a tax deduction?

You have to satisfy a few conditions:-

-

There must have been an enforceable sale.

-

All reasonable attempts have been made to collect it.

-

The decision to write off it off is evidenced in writing.

-

The customer hasn’t already gone into liquidation or you haven’ t accepted a deal to be paid only x cents in the dollar.

That all said, if you declare income on a cash basis then there is no deduction to be claimed for a bad debt as there wasn’t any taxable income in the first place.

So how do you avoid the cost of a bad debt? Look out for future blogs including what the real costs of a bad debt can be.

Or better yet, ask us.

We have dozens and dozens of ideas and strategies from dealing with hundreds of clients from many different industries.

Charging credit card fees

Just a warning on charging credit card fees on the back of the ACCC fining Europcar $350,000.

A business can on-charge the credit card fee that they are charged. But no more.

Eurpocar made the mistake of continuing to charge 1.43% despite the fact that the rate they incurred changed over time. Their rate also took no account of different credit card providers charging different rates.

Please refer to the following blogs to learn more.

https://tinyurl.com/yyxuw9r2

https://tinyurl.com/y2py5wfl

Share trader or share investor

Are you a share trader or share investor?

It’s an important distinction as it can make a world of difference.

Both declare dividends as income (with a tax credit for any imputation/franking credits). However:-

-

A share investor is assessed on realised gains (i.e. when a share is sold). Only 50% of the gain is assessed if the share is held for more than 12 months. No deduction is available for realised losses; they can only be offset against capital gains.

-

A share trader is assessed on both realised and unrealised gains (and losses). The cost of shares bought are deducted as purchases, the sales treated as income and the value of shares at 30th June is treated as closing stock (and therefore income).

So are you a share trader?

Well that depends on matter such as:-

-

The amount invested.

-

The frequency of trades.

-

The amount of trades.

-

Whether it is being carried on in a business like manner. In this regard, the ATO always places great weight on the existence of a business plan.

-

Time and money spent on research.

-

The sophistication of the operation including software programs.

It must also be said that the ATO take particular interest in taxpayers who change from one status to the other. Particularly so in years where there are large market movements.

Not sure where you sit?

The ATO has a useful short summary at https://tinyurl.com/y3s8nure

We would be happy to discuss your situation at greater length with you.

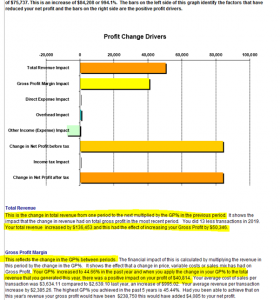

Understanding your numbers

Understanding your numbers? If you are using an accounting package alone, then it is very difficult to understand much about your business.

Why? Because traditional accounting packages, even those in the cloud, only really report on what has happened. They simply tally numbers and throw them into columns. Too many just accept this and continue under the mistaken belief that clumps of numbers for this year and last year is all there is to know.

Far from it.

Any trend could start and/or stop and you wouldn’t know what the impact was. Nor would you be in a position to do something about it.

Trends only become clear when you look at performance ratios, solvency ratios and other KPIs (key performance indicators). We actively use such reports with our clients.

But we do more than that.

We also use other unique software which:-

-

Identifies issues from a high level look.

-

Predicts the outcome of changing drivers of those weakened area.

In the last week, this tool has enabled us to discuss a matters with our clients such as:-

-

A price increase of 4.65% was required to get back to last year’s trading profit.

-

How many customers would have to be lost for a 10% price increase and yet still make the same profit (*).

- That a $136,453 increase in sales only added $50,346 to trading profit at last year’s trading margin. See the image below to see the graph and introductory commentary.

-

In retail where sales are harder to find, that a 1% reduction in overheads was going to save $2,853.

-

That savings overheads of $2,853 would equate to extra sales of $9,086 (at last year’s margin).

-

We separately quantified and discussed the effect of not achieving last year’s margin.

-

For customers paying on average one day early, $2,918 would be added to the bank balance. We also discussed ways to achieve this.

-

For a new client. Setting the cost of goods section correctly in their accounting ledger so they actually know what they make form each sale.

(*) This is the most stunning tool I have ever used with clients. Time and time it both removes fear of the unknown (in this case losing customers) and the conviction to make key changes to the business.

We also presented clients a one page action plan of the steps and the outcome from achieving them. We will catch up every month by Zoom or Skype to monitor and discuss their progress.

If your accountant just drops a set of financials and Tax Returns on your lap and says sign here, then consider what the cost to you of that myopic service is.

Not understanding your numbers? We would welcome the opportunity to discuss your business and the ways in which we can help you. The meeting will be free of cost or obligation, so you have nothing to lose (as against staying where you are).

Income splitting

Income splitting refers to ensuring income is legally earned by a partner or family member and taxed at their lower tax rate.

In respect of share investments, we often find that new clients have done that.

It often surprises me though, indeed just as it is with a new client, how often the high income earner has all the bank accounts and term deposits earning interest in their own name. Having such accounts in joint names is half as bad. The tax burden would be a lot less if held in the name of the spouse name on the lower marginal tax rate (and almost always will still be treated as a joint asset for family law purposes). Same income, better tax result.

Negatively geared properties however require detailed consideration. Negative gearing refers to the situation where the interest and other expenses incurred on an investment exceed the income from that investment. The tax break on negative gearing often dictates that the investment be made in the name of the high income earner. That said, with the 10 year bond yield under 1%, interest aren’t going up in a hurry – which means that properties become more quickly positively geared than they have in recent years. In other words, getting a tax break doesn’t last for that long and actually becomes a tax problem relatively quickly.

The other factor for consideration is when will the property be sold.

If in retirement, the tax burden may be low; if whilst working the tax could be eye watering.

We welcome any tax question you may have.

ATO threatening SMSFs

Last week the ATO wrote to 17,700 self managed super funds (SMSFs) and threatened fines of up to $4,200. That’s one in every 33 SMSFs! The threat was issued to trustees where their SMSF had more than 90% of its assets in one asset class.

But that in itself is not a breach.

As all SMSF trustees will know:-

-

Their fund must have an investment strategy, and

-

An investment strategy must consider investments, providing retirement benefits, risk and diversification, and

-

That SMSFs are audited (and the ATO have already audited the auditors).

You might well therefore ask why the threat. And more to the point, why threaten trustees and do so with significant fines.

Whilst this approach seems unnecessary, some funds may need to better evidence their decisions.

There is nothing wrong with having the bulk of your SMSF assets in just one class. You just need to make sure your investment strategy evidences that and the reasons why.

If there is an issue it remains in respect of property owned by a fund in, or largely in, pension mode. There comes a point for some SMSFs paying pensions that the rate of return (i.e. net rent) is below minimum pension levels. Pension payments are based off market values, so in time cash reserves can be drained (noting that the minimum pension rate is 6% of asset values from age 75, 7% from age 80 with escalating increases thereafter). The problem escalates if the property becomes untenanted.

In closing, I’d like to make three points:-

-

Investment strategies are not set and forget documents. They were introduced to force trustees to evaluate and monitor all investments.

-

Measuring SMSFs investment mix/percentages based off numbers as they are 30th June is prone to error. Accumulation funds are often flushed with cash at 30th June with last minute contributions (although not so true today with such low concessional contribution caps). Conversely, pension funds are typically low on cash at 30th June as many SMSFs only pay pensions in the back end of June.

-

This is again a reminder of the many reasons as to why the trustee of a super fund should be a company and not individuals. If the ATO is successful in fining the corporate trustee of a SMSF over this matter then the fine will be $4,200. If individuals are trustees, the fine will be $4,200 per trustee. Four trustees means the ATO will pocket $16,800! And remember that such fines must be paid personally; the fund can’t pay it on the trustees behalf.

We will be contacting our SMSF trustees who may receive such letters. If you do though have any questions, please don’t hesitate to call us.

The ATO are auditing Healesville (and Hornsby)

The ATO’s audit and review processes continue to expand – both in number and the way they are conducted. The ATO has just announced that it is heading off to Healesville where it will visit 400 small businesses within the next month.

They are also off to Hornsby.in Sydney.

The ATO’s press relates states that “people from the Healesville area have told us about some building construction businesses getting an unfair advantage over their honest competitors by not paying by the rules.” Their press release went on to talk about taking action against the black economy and specifically about non-compliance employer obligations.

At the same time, the ATO are running information sessions to assist small businesses; including Single Touch Payroll (STP).

So if the focus is on building and construction within a smallish country town, then it looks like they will match up all the transactions between businesses that operate within that sector.

Such a pilot program was undertaken in the Hunter Valley some years ago. It focused solely on plasterers – both plasterers themselves and those that provided good or services to them. It was so successful that it lead to the reporting of all contractor payments (Taxable Payments Reporting) within the building and construction industry. And that system has been so successful, i.e. raised money and fines and interest, that it has now been expanded to include couriers, security and computer programmers.

One can only suspect that if they find under declared wages then they will rightly notify WorkCover.

It will be interesting to hear what they find.

National Scam Awareness Week

The National Scam Awareness Week was actually last week. However conversations with clients and others revealed just how exposed we all are. It should also be said that being aware and protecting oneself from scams is an ongoing task and not just and activity for last week.

That said, one can largely protect themselves through just common sense, awareness up-to-date software and scanning programs.

The Australian Competition and Consumer Commission (ACCC) has a terrific homepage.

You can learn more about the various types of scams at

https://www.scamwatch.gov.au/types-of-scams

You can read the latest news and alerts at

You can also view their tools and resources page at

https://www.scamwatch.gov.au/about-scamwatch/tools-resources

And from accounting perspective, always remember the ATO is not in a ring and ask you for personal details nor ask you to pay a debt immediately over the phone.

We are also happy to recommend an IT specialist to set up and monitor your computer system.

What you will doesn’t cover

Do you know what your will doesn’t cover? Many people don’t.

A will cover assets in your own name.

It therefore doesn’t cover:-

-

Jointly held assets such as bank accounts and the family home they go straight to the surviving partner).

-

Assets held within discretionary trusts.

-

Super (see future article).

-

Life insurance policy (goes to the owner).

Some people own everything in their own name.

On the other hand, other people have little in their own name. It is no uncommon to see a millionaire under age 65 have little in their own name, particularly if they are in business or can be sued for other reasons.

Everyone should have a will. It is your chance to set out who your assets are to be distributed to. Proper planning ensures this is done in the most efficient and tax effective manner. You therefore not only need a lawyer but often a financial planner as well. It should never be done on the cheap if the bulk of your toil and investments reside in a trust or self managed super fund.