Posts Categorized: BAS and super obligations

Am I eligible for PAYG Withholding relief?

By far the most common question being asked now by small businesses is am I eligible for PAYG withholding relief?

There have been two announcements with the effective doubling of the concession on the second stimulus package as announced last Sunday.

That package was rushed through Parliament earlier in the week. Whilst we now have some clarity, questions still remain.

To qualify a business must:-

-

Have an ABN by March 12, 2020. This is an obvious requirement to avoid restructuring.

-

Make a payment of salary and wages (or directors fees, commissions etc). It doesn’t matter that there may be no requirement withhold PAYG withholding if the wages are small.

-

Either have (a) lodged the 2019 Tax Return by March 12, 2020 which reports assessable business income or (b) lodged an activity statement for the 2019/20 year which declares business income (which is presumably either sales subject to GST and/or business income subject to PAYG Instalments).

-

The entity has not engage in a scheme for the sole or dominant purpose of seeking to make the entity entitled to the payment would increase entitlement entity to the payment. In other words, tax avoidance.

The ATO has also stated that they will review sudden changes to the characterisation of payments and investigate whether the payments are in fact wages. This is quite reasonable where PAYG withholding and not been reported and SG super contributions had not been made. We also note that some people who may wrongly trying claim may have a hard time proving so where there is no WorkCover policy in place. This is much easier for the ATO to determine given the introduction of Single Touch Payroll for all employers from July 2019.

However, questions do remain.

In particular, it is very common for a business owner to only draw a salary at the end of the financial year when the business is known to be profitable. It would be most unfair if they were to miss out.

We will post further information when matters are made clearer.

In the meantime:-

-

We would be happy to answer any question you may have.

-

Ask you to keep returning to this section as blogs will be posted at least twice daily

Tax-free “payments” to employers

The main plank to the first and second government stimulus packages has been the announcement of tax-free payments to employers.

It is been incorrectly reported as a payment to employers.

However, there will not be a payment in all cases.

It will be either:-

-

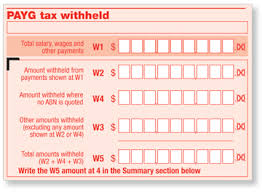

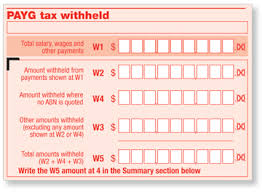

Larger employers will not pay the first $50,000 of PAYG Withholding in respect of the months January to June inclusive (they can also benefit in the first half of 2020/21 but we will cover that in a future blog).

-

Employers who withhold less than $10,000 of PAYG Withholding per year, they will receive a minimum credit of $10,000. If that $10,000 is greater than the other BAS liabilities, then the balance will be paid to the employer.

For those that report PAYG Withholding monthly, they can claim the credit for January and February on the March BAS.

The ATO best describes this as a Cash Flow Boost.

Employers will still be allowed to claim all of the PAYG Withholding as a tax deduction – even though it is not paid.

Employees will still be allowed to claim a tax refund for all of the PAYG Withholding reported – even though the employer has not paid some or all of it.

The ATO has stated that they will pay refunds within 14 days.

Please come back to read updates on how you can benefit from this concession. We also welcome any question you may have.

SG amnesty – prior reported breaches

An employer who is late in paying their super must pay it to the ATO on an SG Super Charge Statement.

An admin charge and lost earnings component are added to the amount payable. Worse still, the total amount paid is not tax deductible. As we always say super liabilities are the liabilities you pay first.

Last week the SG Amnesty laws were passed by Parliament. This amnesty allows employers to report and pay any underpaid super and do so without the usual penalties.

What it also enables is those that have previously lodged a SG Super Charge Statement to seek a refund.

We welcome the opportunity to assist you with this and will provide guidance once we have been trained on the amnesty.

SG super amnesty

The Senate passed the SG super amnesty bill last week. All that is required now is for it to receive royal asset after which it becomes operational law; that process usually only takes a few days.

This amnesty allows employers to come forward and declare underpaid SG super and do so without the normal (hefty) penalties.

It has been quite a political journey to finally get to this stage. The bill was first introduced into Parliament two years ago. It never received support and lapsed with last year’s election.

We are pleased that it has been passed as we believe many employees will benefit. Whilst we are abhorred and disgusted by those employers who don’t pay any of their compulsory super obligation, there are many cases where innocent oversights have resulted in relatively minor under payments. This amnesty should see a considerable amount of super paid to the benefit of employees.

Full details of this amnesty have yet to be explored and analysed. We await training on this and look forward to explaining more in due course.

We strongly encourage all employers to not miss this opportunity.

All employers should review their level of compliance since 1992. Why 1992? Well the system was introduced in July 1992 and the ATO can go back audit any period they like. And one thing about an amnesty; once they are over, the ATO comes out with baseball bats.

We welcome any question you may have but look forward to explaining more shortly.

Don’t forget to register for GST!

Don’t forget to register for GST! If you don’t it could be costly.

The GST registration threshold for businesses that are not non-profits and taxis is $75,000. If your annual turnover exceeds $75,000 and you are not registered, then the ATO will demand you pay them 1/11th of your turnover.

It can prove rather costly!

Where turnover is not seasonal, we recommend that clients register once their turnover exceeds $6,000 per month. And sometimes earlier if they will soon be at the limit and have good accounting processes (which we can help set up).

Not sure what is best for you – call us for a free discussion.

Am I required to register for GST

Am I required to register for GST is a question we often get. The answer is that it depends.

If you operate a business, you are required to have an Australian Business Number (ABN). But this doesn’t mean you have to also register for GST.

Whether you have register depends on your turnover (sales/fees, etc). You must register your for GST if your annual turnover exceeds $75,000 ($150,000 for non-profit organisations; taxi drivers are required to register for GST irrespective of their turnover).

Sounds clear cut – not really!

Annual turnover is defined as being for the current month and the next 11. That’s right, you are expected to be a clairvoyant! That said, one should register once their monthly turnover starts exceeding $6,000 per month – with separate consideration for seasonal business.

Should I register if my turnover is under $75,000?

Well that depends on a number of considerations such as:-

-

Do I want to look bigger to my customers?

-

Are my customers the public or businesses? If they are the public, then your price goes up by 10% (but you get to claim back any GST paid). If they are the business, then they can claim back any GST claimed.

-

If you supply a GST free service such as food and medical supplies, then you won’t charge GST but you will get o claim back GST.

-

Am I going to be able to efficiently run a proper accounting file in order to track and report GST?

So what is best for you? We would be happy to discuss your situation – please call us.

STP and super payments

The roll-out of Single Touch Payroll (STP) has proved to be an interesting process!

For some, it just meant clicking another button or two within their payroll program.

For others it meant changing the whole way they processed their payroll.

It has also uncovered some interesting practices.

We have been somewhat surprised to find that some clients weren’t making their employee SG super payments through a SuperStream, nor using a super clearing house. The former is the payment method, the latter is the notification of employee’s contributions. We have also been surprised to learn that super funds, like some of the really big ones, have still been accepting cheques.

There are free solutions out there but the best solution is almost always the one built within your payroll software. Whilst there may be a cost, it is nominal and avoids double handling.

Please call us if you would like to discuss your situation and needs.

Other STP tasks

Single Touch Payroll (STP) started for all non-large businesses two weeks ago. So all business should by now be reporting wages at the time of payment.

For some this has meant using a payroll software program for the first time. This was the perfect opportunity to ensure that all other HR employment requirements had been attended to.

If you are still struggling with all of this then please contact us so we can discuss ways in which we can help you.

STP starts next week!

Single Touch Payroll (STP) starts next week!

From Monday 1st July all businesses will be required to report to the ATO each employee’s gross pay, tax and super no later than the day of payment.

Whilst there are extensions available we generally recommend not using them as it only creates more work later – and therefore cost.

If however you need to rely on an extension, then you must have applied for one by week’s end.

Either way, you have to do so something.

We have been taking our clients through the transition journey principally by way of a series of weekly preparatory emails.

If your accountant hasn’t helped you then it is time to change accountants! Contact us below and we can discuss how we can help you.

STP – changes at the top

It came as a personal surprise to see that the super impressive head of Single Touch Payroll (STP) at the ATO resigned on Friday. He has done so just two weeks before some 700,000+/- small businesses are required to report wages at the time of payment.

What are we to make of that?

As of two weeks ago, not even 120,000 businesses in the country were registered for STP. One can only therefore conclude that the vast majority businesses will not be ready for STP come 1st July. That is just 2 weeks from today.

In part, this is not really surprising. STP is the biggest operational change since GST. Moreover, it relies heavily on public accountants being able to help all of their clients. And the reality is that the majority of public accountants haven’t been able to meet their 2018 tax lodgement program and are drowning in overdue Tax Returns. They simply don’t have the time and resources to support what is required to implement STP.

At Maggs Reid Stewart, we are progressively taking our clients through a series of weekly preparatory tasks. And as part of this process, we are guiding clients to clean up their HR systems.

If you are struggling with STP and/or your accountant is not helping you, then please call us. And do so today because this is not something you can attend to on the first pay day in July.