Posts Categorized: Business improvement & efficiency

A short case study in improving cash flow #1

Every business owner is rightly concerned about cash flow.

It is not uncommon to see profitable business fail due to poor cash flow.

Yet it never cease to amaze me how little tweaks in a business can deliver dramatic results.

Take the case with one client last week. In our annual general meeting, our analysis software uncovered, amongst many other things, that the business’s cash flow would improve by $8,753 for every day they got they reduced their debtors’ turnover. In their case, this meant having all debtors pay on average with 33 days from the date of being invoiced, not 34. Not much of a change for a big result.

Imagine if they found ways to have their debtors pay on average 10 days earlier. That would mean that they would have an extra $87,530 in the bank at any one time!

For some this could have flow on effects by paying less or now overdraft interest.

We have dozens upon dozens of ideas and ways in which to improve debtor receipts gained from our many years of experience of dealing with many clients in a variety of industries.

We would welcome the opportunity to explore the way in which we can help you. And as our first meeting is free, you nothing to lose – and potentially a lot to gain.

When can I claim a bad debt as a tax deduction?

When can I claim a bad debt as a tax deduction?

You have to satisfy a few conditions:-

-

There must have been an enforceable sale.

-

All reasonable attempts have been made to collect it.

-

The decision to write off it off is evidenced in writing.

-

The customer hasn’t already gone into liquidation or you haven’ t accepted a deal to be paid only x cents in the dollar.

That all said, if you declare income on a cash basis then there is no deduction to be claimed for a bad debt as there wasn’t any taxable income in the first place.

So how do you avoid the cost of a bad debt? Look out for future blogs including what the real costs of a bad debt can be.

Or better yet, ask us.

We have dozens and dozens of ideas and strategies from dealing with hundreds of clients from many different industries.

Understanding your numbers

Understanding your numbers? If you are using an accounting package alone, then it is very difficult to understand much about your business.

Why? Because traditional accounting packages, even those in the cloud, only really report on what has happened. They simply tally numbers and throw them into columns. Too many just accept this and continue under the mistaken belief that clumps of numbers for this year and last year is all there is to know.

Far from it.

Any trend could start and/or stop and you wouldn’t know what the impact was. Nor would you be in a position to do something about it.

Trends only become clear when you look at performance ratios, solvency ratios and other KPIs (key performance indicators). We actively use such reports with our clients.

But we do more than that.

We also use other unique software which:-

-

Identifies issues from a high level look.

-

Predicts the outcome of changing drivers of those weakened area.

In the last week, this tool has enabled us to discuss a matters with our clients such as:-

-

A price increase of 4.65% was required to get back to last year’s trading profit.

-

How many customers would have to be lost for a 10% price increase and yet still make the same profit (*).

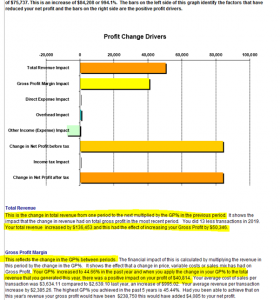

- That a $136,453 increase in sales only added $50,346 to trading profit at last year’s trading margin. See the image below to see the graph and introductory commentary.

-

In retail where sales are harder to find, that a 1% reduction in overheads was going to save $2,853.

-

That savings overheads of $2,853 would equate to extra sales of $9,086 (at last year’s margin).

-

We separately quantified and discussed the effect of not achieving last year’s margin.

-

For customers paying on average one day early, $2,918 would be added to the bank balance. We also discussed ways to achieve this.

-

For a new client. Setting the cost of goods section correctly in their accounting ledger so they actually know what they make form each sale.

(*) This is the most stunning tool I have ever used with clients. Time and time it both removes fear of the unknown (in this case losing customers) and the conviction to make key changes to the business.

We also presented clients a one page action plan of the steps and the outcome from achieving them. We will catch up every month by Zoom or Skype to monitor and discuss their progress.

If your accountant just drops a set of financials and Tax Returns on your lap and says sign here, then consider what the cost to you of that myopic service is.

Not understanding your numbers? We would welcome the opportunity to discuss your business and the ways in which we can help you. The meeting will be free of cost or obligation, so you have nothing to lose (as against staying where you are).

When growth is bad (and running out of cash)

The following is a re-post from February 2015. It has been re-posted as it has been a topic of discussion with a couple of existing clients as well as potential new clients.

With our existing clients, we are planning around how fast they can grow and the issues around including cash flow, cash reserves, need to borrow as well as many other issues including their staffing and training. We have created a clear picture of what sustainable growth will look like, can measure how we are tracking and are dedicating the necessary resources in a planned roll-out.

On the other hand, some potential clients have come to us and they have found themselves, as you could say, in a pickle. Sadly with no proper planning they didn’t see it coming. It has come as a very rude and great shock. Pity their accountants didn’t provide such planning and cash flow assistance.

Last week I queried whether your plan will work and touched upon good and bad growth.

Increasing sales is not the answer to everything. It is not uncommon to see a business solely concentrating on increasing sales fall part if they haven’t ensured the business has the right team and systems in place to support greater turnover.

Worse still, some businesses even fail as they run out of cash due to the increased revenue not being enough to fund greater expenses and the greater amount of money locked up in debtors and stock.

Consider this……

Take a business that doubles its sales from $1,000,000 to $2,000,000 and everything else doubles from:-

- Cost of goods sold from $700,000

- Overheads from $175,000

- Net profit from $75,000 (average tax rate remains at 40%)

- Debtors from $125,000

- Stock from $160,000

- Creditors from $75,000.

Sounds good?

Actually, it’s a disaster.

Why – because the working capital required has doubled from $210,000 to $420,000 whilst the doubling of profit after tax has only generated an extra $150,000 – of which $60,000 will go in tax. What seems to be a new dawn will actually prove to be a nightmare. The business owner in such a case might think they are going forward in the right direction but there is something coming awfully big and fast straight at them!

The problem here is that the owner has concentrated on sales and sales alone. The outcome would be quite different if other key drives such as debtors, stock and creditors turnover were addressed (and for which we have many strategies from our many years of experience and supporting tools).

We were a member of the Principa accountants network (from which this example was generated) as well as other accounting groups that provide tools to assist our clients with cash flow control and planning – and for many other areas as well.

Why not refer to our web page’s article on business improvement potential. Or better yet, why not ring Alex Stewart and make a time to sit down and have an obligation free meeting to discuss how we can help your business.

So again I ask, will your plan work?

Improving cash flow

Want to improve your cash flow?

Not much of a question really – of course you do.

For some it is easy as making it easier for your customers. For those providing a good or a service, it can be as easy as taking payment upon or before delivery. And for some this can be as easy as using Square, Pay-pal and other such options.

You are asking for payment at the time – and isn’t easier to ask to be paid at the time of the exchange? You are also making it easier for your customer / patient to pay you.

Want other cash flow tips? We have hundreds obtained from our experience of working with a wide range of clients form different industries. Call us.

Receipt Bank – another way to better help you

We are always looking for ways to make your life easier.

Our latest initiative is Receipt Bank, a tool which allows a more automated bookkeeping workflow, solves typical specific compliance problems and serves as a back-up system. It does so in a most cost effective manner.

Receipt Bank allows you to upload your business receipts, invoices and expenses into your software or provide them to us seamlessly and easily. You can do so via photo on a mobile app downloaded to your smart phone or via personalised @ Receipt Bank email address.

The twelve main benefits from using Receipt Bank:-

- You save time on sending in your paperwork, time that you can spend on your core business services or more time not attending to paperwork.

- You can use up to any one or combination of four methods to submit information to Receipt Bank.

- The two main methods are taking a photo on your mobile phone or on-forwarding an e-mail.

- It is great solution to those who incur lots of costs on the road whether it be coffee meetings or receipts from Bunnings that are paid by cash or credit card.

- You limit the number of questions we ask.

- You don’t have to forage for receipts from up to 23 months ago.

- You save space as there’s no need to retain your physical documents (if you so wish), with all documents easily searchable and securely stored on the cloud.

- Or you can still keep those physical records but sleep easy in the knowledge that you have a back-up. Furthermore, you can rest easy knowing that your data is stored securely and encrypted.

- You now have real time information flowing into your accounting system, which allows us to provide you with better and more timely insights to improve your business. Receipt Bank works best with Xero and QuickBooks Online.

- No more lost receipts & invoices! No more paying too much tax or GST because you lost invoices and receipts.

- You can access your records from anywhere anytime.

- You can also rest easy in the knowledge that you have read only access after your business has ceased operating.

We welcome your call so e can explain the benefits to you – and other ways we can both simply and improve your life.

Cash flow troubles

Xero has just released its big data cash flow analysis of it users from January.

Xero in its Small Business Insights has reported that 50.12% of its users were cash flow positive in January. This means that just on every second business consumed more cash than came in during that month. And that is probably after keeping tight control of the purse strings.

January as we all know is usually the toughest month of the year for most small to medium sized businesses. And with that comes great stress and sleepless nights.

We have tools that will help you track your cash flow and forecast where it is going.

We also have many years of experience of dealing with all sorts of business. We can draw on that wealth of experience to help you improve your cash flow.

Ask us how by calling us to arrange a free meeting.

Cash flow control

In Xero’s most recent edition of Small Business Insights, they reported that those businesses with positive cash flow fell in December for the first time in four years.

What this means is that less businesses received more money than they paid out. With cash flow and cash holdings being the life blood of any business, this is of concern.

Business confidence was down in December. Retail sales were weak (but often this should be viewed in conjunction with January retail sales data).

We also have the doubt that comes when the polls say that there will be a change of government at the upcoming election. Last year Budgets tend to be generous but perhaps investors and households are more interested in what Labour’s major tax policies mean to disposable income. People and markets tend to fear change more than the change itself. The election can’t come soon enough!

Ask us if you want to find out ways to improve your cash flow. We also have tools that help you control and predict your cash flow. WE can even roll out a projection on a daily basis. Stop losing sleep and ask us!

Cash flow – get paid quicker

Cash flow. If you want to get paid faster make it easier for your customers.

Provide your customers with a link on an invoice to pay via a payment gateway.

There are many of them such as Paypal, Square and Stripe. Ask us which is the best solution one for you.

Will these solutions cost you money – yes the will. But that cost will be covered by giving you the use of sales money earlier and avoid lost time from chasing payment. And don’t start me on bad debts – that will be a future blog.

Cash flow – getting paid quicker

If you want to get paid quicker by your customers make it easy for them. One way to do so is to provide credit card facilities. Yes, you may be charged merchant fees but that is usually cheaper than the costs incurred in carrying your debtors.

Call us if you would like help with this.