Posts Categorized: General

Urgent SG super reminder

Wednesday 28th April is the end date for satisfying Super Guarantee (SG) super obligations for the March 2021 quarter.

But beware as some of the clearing houses have a submission and payment deadline well before then. May be even today!

SG super is payable on all forms of remuneration including:-

-

Commissions

-

Bonuses (but see below)

-

Directors’ fees and all other forms of remuneration to directors

-

Allowances (except where fully expended)

-

Contractors paid mainly for their labour

But excluding the following remuneration:-

-

Overtime

-

Reimbursements

-

Unused annual leave on termination

-

Remuneration of less than $450 in a month

-

Bonuses that are only in respect of overtime

-

Bonuses that are ex-gratia but have nothing to do with hours worked; which is harder to satisfy than what you might think

-

In respect of employees younger than 18

-

Employees carrying our duties of a private or domestic nature for less than 30 hours in a week (such as nannies)

-

On quarterly remuneration greater than $57,090

-

Non-residents performing work for an Australian business outside Australia

If your payroll system has been set up correctly then it will perform these calculations for you. We would welcome the opportunity to assist you with this and if need be refer you to a good book-keeper.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, and SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

The SG rate remains at 9.50%.

So if you haven’t paid your employer super obligations already, we recommend doing so today!

Do I have to pay FBT on my workhorse vehicle?

Do I have to pay FBT on my workhorse vehicle (think utes, vans and taxis)?

Well it depends.

There has and still is an exemption for private use that is minor, infrequent and irregular.

The problem is the ATO recently announced safe harbour provisions. And those safe harbour provisions are probably more restrictive than what most people think.

These provisions also dictate record keeping that wasn’t required previously.

Want to know more – then click on the following link.

FBT Flyer – Workhorse Vehicles and new safe harbour provisions

Why is this important?

Well if any private use doesn’t satisfy the safe harbour tests to minor, infrequent and irregular travel then the business is subject to Fringe Benefits Tax.

And this leads to the next point of how important it is to lodge an FBT Return (even if no FBT is payable). Lodging and FBT Return starts the audit clock ticking. When three years have passed, the ATO can’t go back and audit that year. Don’t lodge a FBT Return and they can go back as far as they like.

Not sure about your exposure? Don’t want to risk not complying and paying FBT 9and penalties and interest)? Then call us.

How are your customers affected by JobKeeper?

There has been much press about the ending of JobKeeper and what it means. The press has largely focused on the most exposed industries such as cafes and restaurants, particularly those in the CBD.

So the question is how exposed is your business if your customers are at risk?

At worst, it may be best to not sell to someone who is at risk of falling over.

So, if

-

it costs you $600 to service a $1,000 sale and

-

they go down owing you $2,000

Then you will need sell someone else another $5,000 just to cover that loss. It’s a tough assignment at any time let alone in today’s market for many business owners.

The sad reality is that most accountants don’t ensure their clients accurately record and report on the trust cost of servicing the sale of a good or service. It’s really really important to know this so for so many reasons – but in context to the discussion here, knowing what is at stake when making a sale that may not be collectable.

So think about whether you should continue to sell to existing customers. Another option is to ask for payment up front.

And now would be a good time to review your terms of trade. And with that, you should consider whether it is worth protecting your interest under the Personal Property Securities Act (PPSA) – the modern form of Romalpa clauses. It’s a measure of last resort but can save your bacon. It’s beyond the scope of a blog to explain how you can use PPSA but we would be happy to explain it to you and refer you to a qualified solicitor to attend to the necessary paperwork.

So in these difficult and unusual times:-

-

Don’t sell to anyone without evaluating their ability to pay.

-

Put the proper protection mechanisms in place.

-

Be crystal clear on what it costs you to sell your goods and/or services.

Want to better understand your situation? Then ask us as we have decades upon decades of experiences gained from a range of clients operating in an array of industries.

Why is the ATO suddenly asking you for money?

If you want someone to pay you then it is a good idea to send them a bill so they can. Seems like common sense – but not to the ATO.

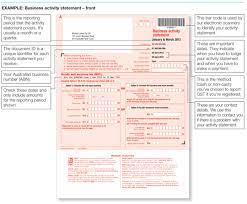

A number of clients have been surprised, offended and/or doubtful of recent payment requests from the ATO. This happened as the ATO elected to cease sending paper activity statements. It seems as though many did not receive a reminder through their MyGov account – or if they did, ignored it legitimately thinking it was a scam.

So will you get into trouble?

The answer is no.

We understand that the ATO will revert to issuing paper statements.

We do though recommend periodically checking your MyGov account just in case you have missed something. Once you have opened a My Gov account, they will no longer issue you with a physical assessment notice; even we aren’t issued with one. They also cease issuing super S293 notices and the like.

But never click on a link within a MyGov email as it may well be a hoax. Log in separately from your internet browser.

Why getting your FBT exposure right is so critical

So why getting your FBT exposure right so critical?

Before we answer that question, I will answer the base question of what is a fringe benefit. A fringe benefit is anything provided by an employer to an employee other than by wage/salary and super.

As such it includes such things as:-

-

Passenger cars

- Car parking

-

Entertainment

-

Selling firm’s goods at a discount

-

Providing accommodation

-

Paying any employee bill whether that be school fees, mortgage, health club membership and so on.

And this leads to the understanding of how to address your FBT exposure which can be summarised as:-

-

Determine whether you the employer are exempt (charities, public hospitals) or subject to a reduced rate (private schools).

-

Determine what fringe benefits you have provided to whom

-

Assess whether an exemption or concession applies to that type of benefit. There are some special rules which benefit small businesses.

-

Calculate the taxable value

-

Then, and this what most people get wrong, determine whether the employee is better off making a contribution to reduce the fringe benefit rather than pay FBT tax (which is equivalent to the highest marginal tax rate).

-

Prepare and lodge the FBT Tax Return.

The reality is that all too many employers get this wrong as the ATO is successful in making an adjustment in 50% of FBT audits. That’s every second audit!

And don’t think the ATO doesn’t think this is a big audit target. One recent project was their recording the number plates of all utes parked at an AFL game at the MCG. Those plate numbers registered to companies were then cross matched with lodged FBT and Income Tax Returns. The ATO had a field day.

So what should you do?

Well for our clients we run through a checklist to make sure all benefit s provided are identified. We will then work through (a) quantifying the benefit before (b) determining the most efficient manner of dealing with the benefit and then (c) lodge an FBT Return (we do this even if the taxable value has been reduced to nil as the ATO have therefore issued an assessment and then only have two years to audit.

And with that I return to the question of why is getting your FBT exposure right is so critical? As you will now be able to appreciate there is more than answer to this question:-

-

It is a key ATO audit area.

-

If it is wrong in one year, the ATO will start auditing all years.

-

With the FBT tax rate being the equivalent of the highest marginal tax rate, the tax can be significant.

-

The ATO readily applies both interest and penalties.

-

The audit clock will start clicking once an FBT Tax Return sis lodged – after that the ATO can’ t go back further than 2 years.

Do you have any questions? We would welcome the opportunity to discuss them with you.

JobKeeper reminder & reality check

We will start with an important reminder to meet your turnover reporting obligation in order to receive your February JobKeeper entitlement by this coming Friday. This means you have to report the actual GST turnover for the month of February and what you think it will be for March.

And with JobKeeper due to conclude with the fortnight ending 28th March, this is the second last time you or your accountant will need to complete this task.

The bigger issue though on the horizon is what happens when JobKeeper ends?

Whilst the drop in the unemployment rate and growth in the GDP rate have been welcome, come April small businesses will be on their own. There is no (as yet but will there be?) targeted assistance to those industries decimated by covid.

So the four biggest questions you face are?

-

How will your business survive?

-

How will the businesses of your customers and suppliers survive?

-

And have you, your customers and suppliers addressed the impact of the end of rental relief? And not only may you soon be paying full rent, what about the portion of relief that was deferred?

-

And are your financiers going to continue to support you?

And with cash flow being the life blood of any business you need to understand what the impact starting in as soon as 3 weeks. Some accounting software providers market their cash flow capabilities, but it is very simple and for the immediate short term.

We however have advanced software which can:-

-

Model out various post 28th March scenarios.

-

Show the cash flow peaks and troughs in the months ahead.

And with our many years of collective experience of working with all sorts of industries, we are able to provide recommendations as to how to rectify and improve what is predicted to unfold.

Our first meeting with clients is free of cost or obligation and we welcome your call.

Am I paying the right award wage?

Awards set out employment conditions and minimum pay rates.

There are over 100 industry based awards and they cover most workers in Australia. That said, whilst financial planners come under an award, accountants don’t; but some workers within an accounting firm may come under an office award depending their duties.

Larger employers with a registered agreement in place have the terms of that agreement over-rule any award(s) that may otherwise be applicable.

Awards can also determine what the default super choice fund. No wonder industry super funds have go to be so big!

So with all this complexity it’s important to make sure you pay under any applicable award. But how do you do that?

You can find a list of awards at – https://www.fairwork.gov.au/awards-and-agreements/Awards/list-of-awards

Better yet, you can see what awards that may relate to your employees at Fair Work Australia’s award checker – https://www.fairwork.gov.au/awards-and-agreements/awards/find-my-award/ Please also refer to clause 4 as that is usually the clause that sets out who is covered by the award. You can also check the most important job classifications which can usually be found within the pay clause or a schedule.

Can you benefit from the new Vic Govt support package?

Yesterday the State Government announced its Circuit Breaker Action Business Support Package.

Unlike past support packages, there is no general entitlement.

The relief is targeted to industries most affected but the snap lockdown:-

-

Licensed hospitality venues who have already received a grant through the Licensed Hospitality Fund will be entitled to a $3,000 grant.

-

Accommodation Support Program has two tiers of funding ($2,250 and $4,500) dependent on the number of cancelled nights. It is an expansion of the existing Regional Tourism Accommodation Support Program and also includes greater Melbourne.

-

An expansion of the Travel Voucher Scheme. A further 10,000 regional vouchers will be issued as well as 40,000 travel vouchers for greater Melbourne.

There will also be a Business Costs Assistance Program for those with annual payroll under $3,000,000. Full details are yet to be released.

You can register your interest in applying for the Victorian Accommodation Support Program at https://www.business.vic.gov.au/support-for-your-business/grants-and-assistance/circuit-breaker-action-business-support-package/victorian-accommodation-support-program

You can read more at https://www.business.vic.gov.au/support-for-your-business/grants-and-assistance/circuit-breaker-action-business-support-package

We welcome any question you may have.

Reducing the tax on Christmas

Entertaining and providing gifts at Christmas time to staff, customers and suppliers is a cost of doing business. However, there are some important FBT, GST and income tax considerations and outcomes.

As an employer, you need to be careful at what you provide at Christmas. The rules are complex and the costs of getting it wrong can prove very expensive.

We will outline some of the more common scenarios and what to be careful of.

Under-pinning the implications are the following key points:-

-

Christmas parties, entertainment and gifts are all treated under entertainment tax rules.

-

FBT applies to benefits given to employees.

-

There are no FBT implications on entertainment and gifts given to customers, clients and suppliers.

-

There are three methods under which an employer can quantify the taxable components of any entertainment expenditure – in fact there are 38 permutations depending on who is entertained where, how and with whom. We will largely address the actual method which is the one used by most small businesses (as it usually results in the best outcome). It is beyond the scope of this briefing to address the 12 week log method and we will only touch upon the 50/50 method where relevant.

-

Christmas comes but once a year and to the best of my knowledge and experience does so on 25th December. Nevertheless, the ATO treats Christmas parties and gifts as being what are called minor, infrequent and irregular benefits.

-

Such minor benefits are FBT exempt where they cost less than $300 (including GST) provided the actual method is used to quantify entertainment.

The Christmas party

Where entertainment is calculated under the actual expenditure method (which is the most common method for small businesses):-

-

If a Christmas party is held on-site on a work day, the whole cost for each employee will be an exempt fringe benefit. So too will the spouse’s cost provided the cost per spouse is less than $300. No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend. Taxi travel to or from the workplace (not both ways) will be exempt from FBT and not tax deductible.

-

If a Christmas party is held off the work premises, then the whole cost will be exempt from FBT provided the party costs less than $300 per person (employees and their spouses). No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend.

-

If an external Christmas party costs more than $300 or more per person then the total cost is subject to FBT.

-

The cost of any entertainment provided during the party (whether that be at the work premises or outside) will be exempt if it costs less than $300 per head – for example a DJ, musician, clown and comedian.

-

The cost of entertaining clients, customers and suppliers is not subject to FBT and is not tax deductible.

-

If any exemption is exceeded then FBT is payable. Consequently, an FBT Tax Return must be lodged and FBT paid (the FBT tax rate being the same as the top marginal tax rate). Please keep this in mind when completing the 2018/19 FBT Questionnaire in early April 2019.

-

All other entertainment during the year will be subject to FBT on a case by case basis.

Where entertainment is calculated under the 50/50 method:-

-

50% of the cost will be subject to FBT and this portion will be tax deductible. The other 50% will not be subject to FBT and will not be tax deductible. An FBT Tax Return must be lodged and FBT paid.

-

Only taxi travel from home to the venue will be FBT exempt and not deductible for tax.

-

50% of all other entertainment during the year will be subject to FBT.

Gifts

The following gifts are exempt from FBT and are tax deductible:-

- Hampers, bottles of wine, gift vouchers, a pen set costing less than $300 (inclusive of GST).

The following gifts are subject to FBT and are not tax deductible:-

- Tickets to a sporting event or theatre, holiday, accommodation, etc.

The GST treatment of gifts is:-

- The GST component of any tax deductible portion can be claimed back.

- The GST component that relates to the non tax deductible portion can’t be claimed.

Please do not hesitate to call us should you have any queries.

Can your business benefit from JobMaker

JobMaker is an additional incentive which was announced in the October Federal Budget. Employers will be paid a generous incentive which take on additional young employees between October 2020 and October 2021.

JobMaker payments will be paid quarterly and will start from February.

Payments will made for up to 12 months from an employee’s start date. This means entitlements run through to September 2022 for those employees employed as late as September 2021.

Registrations opened on 7th December and you need to be registered by 30th April. Those employers who would have been entitled to claim JobMaker will miss out on 3 months of payments if not registered by then. That could be as much as $2,600 per qualifying employee!

Registered employers will receive:-

-

$200 per week for each eligible employee aged between 16 and 29

-

$100 per week for each eligible employee aged between 29 and 35

JobMaker is not available to employers who are receiving JobKeeper.

To qualify, employers must:-

-

Have an ABN

-

Up to date with tax lodgements

-

Registered for PAYG WH

-

Be reporting through Single Touch Payroll

-

Have employed an additional employee – and not just replaced one employee with another

- Had an increase in the payroll amount.

Qualifying employees must have been in receipt of JobSeeker, Youth Allowance or Parenting Payment for at least one month of the three months preceding their being employed. They must also have worked an average of 20 hours per week.

There are many other criteria and considerations. Please fill in the contact form if you would like a copy of our JobMaker white paper.

We welcome any questions you may have.

And like JobKeeper you have to register to receive anything so don’t let this opportunity, or moreover the money, pass you by.