Posts Categorized: General

Staying afloat with better supplier terms (2 min video)

Want to know how much lost sales can be covered by getting a 5% discount from suppliers.

You might be very surprised.

Please click on the following link to find out:-

https://www.loom.com/share/f1f52aba9c164833a94cf2c959baa2f4

We welcome the opportunity to show you how you can safeguard your business in today’s COVID-19 by making any change to the key drivers in your business.

Analysing the stimulus packages

We’ve spent a great deal of time educating ourselves on the many initiatives within the two federal stimulus packages so we can explain them to our clients and employ strategies to keep their businesses alive and maximise any intended concession.

Ditto state based stimulus concessions.

So keep coming back to the web page as we will be blogging at least twice a day on stimulus initiatives as well as business survival suggestions . There will also be short videos and links to future webinars.

You can be assured that we will do whatever we can to help our clients, whether that be from home or the office (for as long as that may last).

We will also have a panel of trusted advisers to help you with your various needs such as IT, human resources, finance and even health and fitness.

In the meantime, we welcome any question you may have.

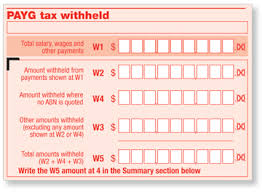

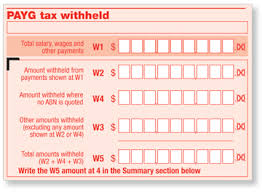

Frustration over unresolved PAYG WH concession frustration

It all sounded so simple. Small business which employ would receive at least $20,000 and as much as $100,000. It wasn’t going to solve the lack of revenue and cash, but, in a small way, would partially help employers to keep employing as many as possible. However, all is not as it seems. Frustration over the unresolved PAYG WH concession is growing amongst all accountants.

I have just checked an accounting Facebook group and everyone is expressing increasing frustration over the lack of clarity over the PAYG WH concession and unfairness over common situations. I have spoken with many accounting colleagues and they too are frustrated.

The interaction of the legislation as passed and how the ATO says they are going to interpret it are going to mean many small business owners will receive no relief either due to the timing of remuneration or form of reward.

It seems that many small business owners who would reasonably understand they would benefit from this PAYG WH concession are going to miss out.

There is much for the government to do at the moment but this major incentive rapidly requires clarification. If necessary, the legislation as passed earlier in the week needs to be rapidly amendment to avoid many small businesses missing out.

We will keep you posted.

Am I eligible for PAYG Withholding relief?

By far the most common question being asked now by small businesses is am I eligible for PAYG withholding relief?

There have been two announcements with the effective doubling of the concession on the second stimulus package as announced last Sunday.

That package was rushed through Parliament earlier in the week. Whilst we now have some clarity, questions still remain.

To qualify a business must:-

-

Have an ABN by March 12, 2020. This is an obvious requirement to avoid restructuring.

-

Make a payment of salary and wages (or directors fees, commissions etc). It doesn’t matter that there may be no requirement withhold PAYG withholding if the wages are small.

-

Either have (a) lodged the 2019 Tax Return by March 12, 2020 which reports assessable business income or (b) lodged an activity statement for the 2019/20 year which declares business income (which is presumably either sales subject to GST and/or business income subject to PAYG Instalments).

-

The entity has not engage in a scheme for the sole or dominant purpose of seeking to make the entity entitled to the payment would increase entitlement entity to the payment. In other words, tax avoidance.

The ATO has also stated that they will review sudden changes to the characterisation of payments and investigate whether the payments are in fact wages. This is quite reasonable where PAYG withholding and not been reported and SG super contributions had not been made. We also note that some people who may wrongly trying claim may have a hard time proving so where there is no WorkCover policy in place. This is much easier for the ATO to determine given the introduction of Single Touch Payroll for all employers from July 2019.

However, questions do remain.

In particular, it is very common for a business owner to only draw a salary at the end of the financial year when the business is known to be profitable. It would be most unfair if they were to miss out.

We will post further information when matters are made clearer.

In the meantime:-

-

We would be happy to answer any question you may have.

-

Ask you to keep returning to this section as blogs will be posted at least twice daily

Managing your team at their homes

We seemed destined to shortly be working from home.

And with that comes new challenges.

Some will be challenging, some will be new, others you may not have thought of.

Warren Howard is both a client and trusted support service. Warren and his team at Howardco specialises in recruitment, HR development and executive coaching.

Warren has kindly allowed me to post his blog on the challenges of managing a team that is working remotely from their own homes.

https://howardco.com.au/blog/working-from-home-were-in-this-together/

I can highly recommend Howardco to you. Unfortunately the first need for many may to handle standing down or terminating team members. Terminating an employee is stressful and unpleasant. Warren is highly skilled in managing the process and making it as seamless as can be.

Commercial rent relief

The federal cabinet is meeting at 10 to discuss measures to provide relief to commercial rent relief to tenants and landlords.

It was flagged by Prime Minister Morrison at the end of his Tuesday night TV press conference.

Whilst commercial rent relief is urgently required, it will be difficult to roll out quickly. It’s one thing to pay pensioners $750 – they are in a data base with all their bank details. It is not more than a pay run. Commercial leases are quite a different beast. There is no central register. They have to be found/report/register. The there is the question of what does each tenant pay.

And there are other issues as well.

Will there be a threshold based of amount of a business’s turnover, rent, area or staff number? Will there be a bias to retail?

We will keep you posted.

In the meantime, please contact us is you have any query in relation to this or any other COVID-19 related matter. And keep coming back to the web page as we will be blogging news, videos and strategies at least twice daily.

How to stay fit & healthy when forced to stay at home (PART 1)

It appears at the time of blogging that it is a now a question of when, not if we go into lockdown.

And with that come new experiences and challenges.

Like staying fit and healthy.

A friend of mine Pete Sleight runs a Vision Personal Training studio in South Caulfield.

Peter has two ways of helping you and says that:-

If your fitness centre has closed and you are feeling a little lost when it comes to your health and well-being, then we have the experience and tools in place to help you stay on track towards your fitness goals.

The ‘HOW‘ may have changed, but the ‘WHY‘ remains the same.

Our community is more connected than ever with Online 1:1 Personal Training Sessions and Online Group Training now available. That’s right, no need to come to us, we will come to you via your mobile, tablet or computer making it never more easier as to WHY you started in the first place.

Stay on track and get in touch with Peter at Vision Personal Training Caulfield to book your free online health and fitness consultation.

I can highly recommend Peter to you and trust this helps many of you to stay fit and healthy.

Peter Sleight

Vision Personal Training Caulfield

Telephone: 04111 77468

Email: psleight@visionpt.com.au

Website: www.visionpt.com.au/studios/caulfield

Tax-free “payments” to employers

The main plank to the first and second government stimulus packages has been the announcement of tax-free payments to employers.

It is been incorrectly reported as a payment to employers.

However, there will not be a payment in all cases.

It will be either:-

-

Larger employers will not pay the first $50,000 of PAYG Withholding in respect of the months January to June inclusive (they can also benefit in the first half of 2020/21 but we will cover that in a future blog).

-

Employers who withhold less than $10,000 of PAYG Withholding per year, they will receive a minimum credit of $10,000. If that $10,000 is greater than the other BAS liabilities, then the balance will be paid to the employer.

For those that report PAYG Withholding monthly, they can claim the credit for January and February on the March BAS.

The ATO best describes this as a Cash Flow Boost.

Employers will still be allowed to claim all of the PAYG Withholding as a tax deduction – even though it is not paid.

Employees will still be allowed to claim a tax refund for all of the PAYG Withholding reported – even though the employer has not paid some or all of it.

The ATO has stated that they will pay refunds within 14 days.

Please come back to read updates on how you can benefit from this concession. We also welcome any question you may have.

Tips to stay positive in the face of COVID-19

We are doing all we can to help our clients. With this in mind, we publish below a series of tips to stay positive in the face of COVID-19.

We give thanks to the UK’s James Ashby who has allowed this document to be openly shared.

COVID-19 matters

We are sorry to have not posted over recent weeks.

In the face of various COVID-19 matters, we have been flat out:-

-

Helping our clients with their challenges,

-

Creating a Business Continuity Plan and support program,

-

Creating and delivering Friday’s business survival webinar,

-

Undertaking necessary precautions internally, and

-

Preparing ourselves for a possible office closure.

We can now return to providing more regular blogs and if you aren’t an existing client, welcome the opportunity to assist you to be informed and in control in these volatile and uncertain times.