Posts Categorized: General

A short case study in improving cash flow #1

Every business owner is rightly concerned about cash flow.

It is not uncommon to see profitable business fail due to poor cash flow.

Yet it never cease to amaze me how little tweaks in a business can deliver dramatic results.

Take the case with one client last week. In our annual general meeting, our analysis software uncovered, amongst many other things, that the business’s cash flow would improve by $8,753 for every day they got they reduced their debtors’ turnover. In their case, this meant having all debtors pay on average with 33 days from the date of being invoiced, not 34. Not much of a change for a big result.

Imagine if they found ways to have their debtors pay on average 10 days earlier. That would mean that they would have an extra $87,530 in the bank at any one time!

For some this could have flow on effects by paying less or now overdraft interest.

We have dozens upon dozens of ideas and ways in which to improve debtor receipts gained from our many years of experience of dealing with many clients in a variety of industries.

We would welcome the opportunity to explore the way in which we can help you. And as our first meeting is free, you nothing to lose – and potentially a lot to gain.

How can I claim car travel?

In order to claim car travel in your personal Tax Return:-

-

You must own the car.

-

You must have undertaken a trip for either your business or your employer.

You can claim under two methods:-

-

Log book, or

-

Cents per kilometre

Tip

You can use a log book kept for three months in the current year or in the last four years (provided the pattern of travel hasn’t changed significantly).

Tip

You must have a properly kept log book. You can do so by buying one in a stationers or you can access an electronic one form our firms app.

Tip

You can claim 68 cents per kilometre under the cents per kilometre method for up to 5,000 work/business strips. This means you can still claim 5,000 km where you travel say 5,500km. Some people choose to do so as it gives them a better claim than under a log book. All you need is a reliable estimate of all trips undertaken during the year.

Want to know what works best for you – call us. We even have a salary sacrifice calculator so we work out the best way to package up a work car and minimise the Fringe Benefits Tax.

SMSF investment strategies

Last month, the ATO wrote to 17,700 self managed super funds (SMSFs) trustees and threatened fines of up to $4,200. The letters were sent to trustees where their SMSF had more than 90% of its assets in one asset class.

It has now come to light that the vast majority of those letters went to those funds where property was the main asset and there was a limited recourse borrowing arrangement (permissible borrowing with super).

The point remains though there is nothing wrong with borrowing nor buying a property within a SMSF. Both are permissible (as long as all relevant requirements are satisfied).

This includes documenting your decisions to do so within an Investment Strategy.

The only thing that appears to have changed is that the ATO has now re-defined a 23 year old requirement and are now expecting trustees to document the decision why you have decided to do so.

Accountants can’t advise on where you should invest your super (they can only provide a template for you to fill in and complete). If you need assistance with the process and/or want to know the long term ramifications of your strategy (and options) then you should speak to a financial planner.

When can I claim a bad debt as a tax deduction?

When can I claim a bad debt as a tax deduction?

You have to satisfy a few conditions:-

-

There must have been an enforceable sale.

-

All reasonable attempts have been made to collect it.

-

The decision to write off it off is evidenced in writing.

-

The customer hasn’t already gone into liquidation or you haven’ t accepted a deal to be paid only x cents in the dollar.

That all said, if you declare income on a cash basis then there is no deduction to be claimed for a bad debt as there wasn’t any taxable income in the first place.

So how do you avoid the cost of a bad debt? Look out for future blogs including what the real costs of a bad debt can be.

Or better yet, ask us.

We have dozens and dozens of ideas and strategies from dealing with hundreds of clients from many different industries.

Charging credit card fees

Just a warning on charging credit card fees on the back of the ACCC fining Europcar $350,000.

A business can on-charge the credit card fee that they are charged. But no more.

Eurpocar made the mistake of continuing to charge 1.43% despite the fact that the rate they incurred changed over time. Their rate also took no account of different credit card providers charging different rates.

Please refer to the following blogs to learn more.

https://tinyurl.com/yyxuw9r2

https://tinyurl.com/y2py5wfl

Share trader or share investor

Are you a share trader or share investor?

It’s an important distinction as it can make a world of difference.

Both declare dividends as income (with a tax credit for any imputation/franking credits). However:-

-

A share investor is assessed on realised gains (i.e. when a share is sold). Only 50% of the gain is assessed if the share is held for more than 12 months. No deduction is available for realised losses; they can only be offset against capital gains.

-

A share trader is assessed on both realised and unrealised gains (and losses). The cost of shares bought are deducted as purchases, the sales treated as income and the value of shares at 30th June is treated as closing stock (and therefore income).

So are you a share trader?

Well that depends on matter such as:-

-

The amount invested.

-

The frequency of trades.

-

The amount of trades.

-

Whether it is being carried on in a business like manner. In this regard, the ATO always places great weight on the existence of a business plan.

-

Time and money spent on research.

-

The sophistication of the operation including software programs.

It must also be said that the ATO take particular interest in taxpayers who change from one status to the other. Particularly so in years where there are large market movements.

Not sure where you sit?

The ATO has a useful short summary at https://tinyurl.com/y3s8nure

We would be happy to discuss your situation at greater length with you.

Understanding your numbers

Understanding your numbers? If you are using an accounting package alone, then it is very difficult to understand much about your business.

Why? Because traditional accounting packages, even those in the cloud, only really report on what has happened. They simply tally numbers and throw them into columns. Too many just accept this and continue under the mistaken belief that clumps of numbers for this year and last year is all there is to know.

Far from it.

Any trend could start and/or stop and you wouldn’t know what the impact was. Nor would you be in a position to do something about it.

Trends only become clear when you look at performance ratios, solvency ratios and other KPIs (key performance indicators). We actively use such reports with our clients.

But we do more than that.

We also use other unique software which:-

-

Identifies issues from a high level look.

-

Predicts the outcome of changing drivers of those weakened area.

In the last week, this tool has enabled us to discuss a matters with our clients such as:-

-

A price increase of 4.65% was required to get back to last year’s trading profit.

-

How many customers would have to be lost for a 10% price increase and yet still make the same profit (*).

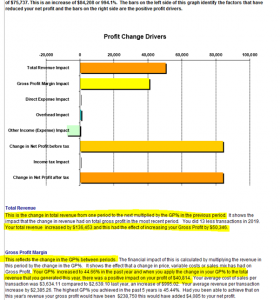

- That a $136,453 increase in sales only added $50,346 to trading profit at last year’s trading margin. See the image below to see the graph and introductory commentary.

-

In retail where sales are harder to find, that a 1% reduction in overheads was going to save $2,853.

-

That savings overheads of $2,853 would equate to extra sales of $9,086 (at last year’s margin).

-

We separately quantified and discussed the effect of not achieving last year’s margin.

-

For customers paying on average one day early, $2,918 would be added to the bank balance. We also discussed ways to achieve this.

-

For a new client. Setting the cost of goods section correctly in their accounting ledger so they actually know what they make form each sale.

(*) This is the most stunning tool I have ever used with clients. Time and time it both removes fear of the unknown (in this case losing customers) and the conviction to make key changes to the business.

We also presented clients a one page action plan of the steps and the outcome from achieving them. We will catch up every month by Zoom or Skype to monitor and discuss their progress.

If your accountant just drops a set of financials and Tax Returns on your lap and says sign here, then consider what the cost to you of that myopic service is.

Not understanding your numbers? We would welcome the opportunity to discuss your business and the ways in which we can help you. The meeting will be free of cost or obligation, so you have nothing to lose (as against staying where you are).

Income splitting

Income splitting refers to ensuring income is legally earned by a partner or family member and taxed at their lower tax rate.

In respect of share investments, we often find that new clients have done that.

It often surprises me though, indeed just as it is with a new client, how often the high income earner has all the bank accounts and term deposits earning interest in their own name. Having such accounts in joint names is half as bad. The tax burden would be a lot less if held in the name of the spouse name on the lower marginal tax rate (and almost always will still be treated as a joint asset for family law purposes). Same income, better tax result.

Negatively geared properties however require detailed consideration. Negative gearing refers to the situation where the interest and other expenses incurred on an investment exceed the income from that investment. The tax break on negative gearing often dictates that the investment be made in the name of the high income earner. That said, with the 10 year bond yield under 1%, interest aren’t going up in a hurry – which means that properties become more quickly positively geared than they have in recent years. In other words, getting a tax break doesn’t last for that long and actually becomes a tax problem relatively quickly.

The other factor for consideration is when will the property be sold.

If in retirement, the tax burden may be low; if whilst working the tax could be eye watering.

We welcome any tax question you may have.

STP and super payments

The roll-out of Single Touch Payroll (STP) has proved to be an interesting process!

For some, it just meant clicking another button or two within their payroll program.

For others it meant changing the whole way they processed their payroll.

It has also uncovered some interesting practices.

We have been somewhat surprised to find that some clients weren’t making their employee SG super payments through a SuperStream, nor using a super clearing house. The former is the payment method, the latter is the notification of employee’s contributions. We have also been surprised to learn that super funds, like some of the really big ones, have still been accepting cheques.

There are free solutions out there but the best solution is almost always the one built within your payroll software. Whilst there may be a cost, it is nominal and avoids double handling.

Please call us if you would like to discuss your situation and needs.

WorkCover remuneration certification

It may be time to complete your 2019 WorkCover remuneration certification. Large employers are required to submit early.

Other employers have delayed lodgement dates. That said, it still may be in your interest to lodge soon. This is particularly the case if your remuneration will be significantly less in 2019/20 than for 2018/19.

You will get back what you over pay based off their estimate; but why over pay in the first place.

You will also ensure it is lodged. Many employers forget to lodge and suffer from WorkCover’s default 20% annual increase. So get it done now when you have finalised and issued the PAYG Payment Summaries.