Posts Categorized: General

5 key actions in 2023

There are always challenges but we seem to currently have our fair share. We currently see 5 key actions required to navigate 2023.

The question is what are you going to do about them? Are you going to let them control you? Or are you going to protect yourself from them to ensure your business or yourself personally doesn’t suffer?

We see 5 risk areas to navigate in 2023:-

- Cyber crime & computer safety.

- Inflation.

- Interest rates (and cash flow).

- Technology.

- Protect personal wealth that is otherwise exposed.

The degree to which these 5 risks affect you may be different to others and may be one or two don’t affect you. But doing nothing is rarely the best option. We therefore encourage you to attend our upcoming webinar on Tuesday 31st January at 5:30 during which we explore these risks – and more importantly, the 5 keys actions you can implement in face of them.

You can reserve your place by clicking here.

And as we are passionate about helping small businesses, we welcome your extending this invitation to family, friends and business colleagues.

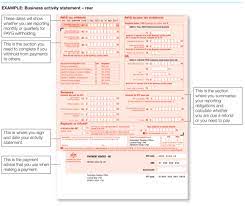

SG deadline reminder

I trust you had an enjoyable festive season – and back into it we go! So here is a quick SG deadline reminder.

Friday 27th January is the end date for satisfying your Super Guarantee (SG) super obligations for the December 2022 quarter.

Please make sure you do not confuse this obligation with the December quarter BAS. The December quarter BAS automatically has a one month extension to 28th February to all. There are no extensions for reporting and payment of SG super.

Please note that super clearing houses take up to 8 days to pass the money through to the super fund. It therefore means that processing and payment to the clearing should be made as soon as possible.

And please make sure you have been calculating super at 10.5% since it increased on 1st July 2022.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

We also take this opportunity to remind you of the imminent migration to Single Touch Payroll 2 with its extra reporting requirements. Please do not hesitate if you would like an introduction to a payroll specialist.

We welcome any questions you might have.

How to avoid making Christmas too taxing

Entertaining and providing gifts at Christmas time to staff, customers and suppliers is a cost of doing business. However, there are some important FBT, GST and income tax considerations and outcomes to keep in mind.

As an employer, you need to be careful at what you provide at Christmas. The rules are complex and the costs of getting it wrong can prove very expensive.

We will outline some of the more common scenarios and what to be careful of.

Under-pinning the implications are the following key points:-

- Christmas parties, entertainment and gifts are all treated under entertainment tax rules.

- FBT applies to benefits given to employees.

- There are no FBT implications on entertainment and gifts given to customers, clients and suppliers.

- There are three methods under which an employer can quantify the taxable components of any entertainment expenditure – in fact there are 38 permutations depending on who is entertained where, how and with whom. We will largely address the actual method which is the one used by most small businesses (as it usually results in the best outcome). It is beyond the scope of this briefing to address the 12 week log method and we will only touch upon the 50/50 method where relevant.

- Christmas comes but once a year and to the best of my knowledge and experience does so on 25th December. Nevertheless, the ATO treats Christmas parties and gifts as being what are called minor, infrequent and irregular benefits.

- Such minor benefits are FBT exempt where they cost less than $300 (including GST) provided the actual method is used to quantify entertainment.

The Christmas party

Where entertainment is calculated under the actual expenditure method (which is the most common method for small businesses):-

- A Christmas party is held on-site on a work day, the whole cost for each employee will be an exempt fringe benefit. So too will the spouse’s cost provided the cost per spouse is less than $300. No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend. Taxi travel to or from the workplace (not both ways) will be exempt from FBT and not tax deductible.

- If a Christmas party is held off the work premises, then the whole cost will be exempt from FBT provided the party costs less than $300 per person (employees and their spouses). No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend.

- If an external Christmas party costs more than $300 or more per person then the total cost is subject to FBT.

- The cost of any entertainment provided during the party (whether that be at the work premises or outside) will be exempt if it costs less than $300 per head – for example a DJ, musician, clown and comedian.

- The cost of entertaining clients, customers and suppliers is not subject to FBT and is not tax deductible.

- If any exemption is exceeded then FBT is payable. Consequently, an FBT Tax Return must be lodged and FBT paid (the FBT tax rate being the same as the top marginal tax rate). Please keep this in mind when completing the 2018/19 FBT Questionnaire in early April 2019.

- All other entertainment during the year will be subject to FBT on a case by case basis.

Where entertainment is calculated under the 50/50 method:-

- 50% of the cost will be subject to FBT and this portion will be tax deductible. The other 50% will not be subject to FBT and will not be tax deductible. An FBT Tax Return must be lodged and FBT paid.

- Only taxi travel from home to the venue will be FBT exempt and not deductible for tax.

- 50% of all other entertainment during the year will be subject to FBT.

Gifts

The following gifts are exempt from FBT and are tax deductible:-

- Hampers, bottles of wine, gift vouchers, a pen set costing less than $300 (inclusive of GST).

The following gifts are subject to FBT and are not tax deductible:-

- Tickets to a sporting event or theatre, holiday, accommodation, etc.

The GST treatment of gifts is:-

- The GST component of any tax deductible portion can be claimed back.

- The GST component that relates to the non tax deductible portion can’t be claimed.

Please do not hesitate to call us should you have any queries.

Important Director Identification Number (DIN) update

This has no doubt been caused by their phone systems being in meltdown. But finally we have some logical relief in having to apply for a Director Identification Number (DIN).

A DIN is required for all directors including those of trustee companies and trustees of self managed super funds.

A director is issued with a unique number irrespective of how many directorships are held.

Thankfully we finally have some common sense relief.

Those that were a director before November 2022 need not apply for a DIN if:-

- The sole or all companies of which one is a director are liquidated before 1st

- The sole or all companies of which one is a director are deregistered before 1st

- A deceased director (you would think this exemption would have bene in place for the start particularly given one of the stated aims of this system is to eliminate phoenix activity).

- Directors who have ceased due to losing capacity.

- Director who resign all directorships before 1st December. Please note though that it appears there is a carve out for this for those who try and re-appoint themselves after 30th November.

If you haven’t applied as yet for your DIN, please do so immediately.

The fine for not doing so is $13,200 and it will be recorded as a criminal offence. It remains to be seen what relief may be given – but don’t rely on that.

Need to no more? Then either call us or check this earlier blog (and related articles).

How you can make sure that your super doesn’t go to the wrong people

How you can make sure that your super doesn’t go to the wrong people? It’s a question anyone with super should ask themselves. Even if your balance is low, a life insurance payment can create a whole new scenario. Peoples biggest 2 assets are almost always their family home and their super. Your Will dictates who is to get our home if it is owned entirely in your own name. If it is owned jointly with your partner, then they will get your half should you pre-decease them; in other words it doesn’t form part of your estate. Your super though is held in trust for you. If your super is with a public fund (industry, retail, employer and so on) then it is up to their board trustees to decide who is to receive your super in the absence of a complying death benefit nomination. The trick is to have the right form of nomination in place. When it comes to self managed super funds, it can become of whole lot trickier. Not only do you need the right form of death benefit nomination in place, but you must be wary of the trust deed. As they are generic in nature, they don’t reflect your wants or desires. Moreover, they can confer general powers which are open to be used in inappropriate ways depending on how the cards fall. In an upcoming 30 minute webinar we will explore:-

The webinar will be held from 5:30pm on Wednesday 30th November. You can register by clicking on the following link – https://us02web.zoom.us/webinar/register/WN_Ov2inp73QdG955M_Bhk9Jg And as we are passionate about helping people to become more successful and secure, we welcome your extending this invitation to family, friends and business colleagues. |

Does your firm comply with Privacy Laws?

Does your firm comply with Privacy Laws? The recent Optus and Medibank privacy hacks have been alarming. They are also a clarion call to assess how your firm collects, holds and protects data.

And clearly what will happen next is that both laws and expectations will tighten. And tighten they will as our privacy and security requirements lag major countries and in particular Europe.

So what must you do?

Firms with group turnover in excess of $3,000,000 must comply and adhere to the 13 principles as set out the Privacy Act.

You can read more about those principles here

But those that handle Tax File Numbers (like tax agents) or medical records must adhere to these principles no matter what their turnover is. Credit reporting firms are also automatically covered by the Privacy Act.

So what does this mean you need to do

Not by all means a complete list, some of the key activities you should undertake are:-

- Consider what data you actually need.

- Consider how your team should best ask and collect personal data.

- Consider what data you hold is sensitive.

- Consider how long you should keep that data.

- Consider how you are going to keep that data – such for how long, is it going to be encrypted, who has access to it.

- Consider where you store data.

- Undertake regular cyber training.

- Adequately train team members on all requirements.

- Review regularly!

- And take out cyber protection insurance – we say this last as prevention is better than cure.

Please ask us if you would like a referral to a suitably qualified technical expert or cyber insurer.

$2,000 grant to help you take control

A new state government grants recognises that whilst many small businesses have survived covid lockdowns they still have lingering needs and require further assistance to ensure:-

- Profitability

- Sufficient cash flow

- Have greater insight over their business

- Better plan for the future (and do so in light of new business norms and changing customer behaviour).

To enable and encourage this, a Specialist Advice Pathways Program grant of $2,000 will be paid to enable the receipt of qualified professional support.

So what are the qualifying criteria to receive the grant?

- Be a company, trust (with a corporate trustee), partnership or individual.

- Have held an ABN at 1st July 2020.

- Being registered as an employer with Worksafe Victoria – that is have a WorkCover policy.

- Have between 1 and 19 full time equivalent employees (presumably at the time of application).

Sole traders and partnerships that don’t employ anyone are not eligible nor are trusts where an individual or individuals are trustees.

Isn’t this great – your business might qualify to receive $2,000 of funding for one or more of these fundamentally key activities:-

- Advice and analysis regarding the management of cash flow, preparation or cash flow budgets and projections

- Profitability analysis and formulation of financial management and/or operational business strategies

- Strategic analysis to revise business planning and/or governance arrangements

- Advice regarding the management of debts and liabilities

- Advice and/or representation regarding commercial agreement contract terms (i.e. commercial leases or commercial supply contracts).

So who can provide these services?

We can (except the last which is legal)! A service provider needs to be a registered:-

- Accountant / tax agent

- Book-keeper

- Lawyer

As such, business coaches are excluded.

So how do you apply for the grant?

Unlike past government grants, we, as the qualified service provider, can’t apply on your behalf.

One must apply by 30th September – but like with past grants, applications will close earlier if the allocated funds are exhausted before then.

Applications will be assessed with a confirming approval email to be sent by the end of October.

It is important that we be involved with this process as:-

- It requires the ABN Registry to be correct for which we will need to check and possibly update (noting that with the ABN system being introduced in 2000, the registry appeared somewhere in the late 2000’s and many not have been updated)

- As the Qualified Service Provider, we need to prepare a service agreement. That agreement either needs to be attached to the application or its key contents set out in the application.

You will need to upload at least one identifying document. You will also need to include my professional membership details.

Other matters of note

- The services must be delivered by the end of January 2023.

- You will need to complete a statutory declaration as to the services provided.

- Payment is made in 2 lots – $1,000 within 20 days of acknowledging the successful application email and within 20 days of completing the final claim form.

- You will also be requested to complete a short survey.

- You will also be required to attest that all industrial relations obligations are being met – which include having evidence of having supplied all employers with the 11 national employment standards.

So what will be the cost of the services I require?

Well that will depend on:-

- How many of the first 4 stated services you require and

- The complexity of your business and

- The quality of your financial information.

We are building a matrix to determine the investment into attending to any of the qualifying services and provide you with the required service agreement.

Where do I register?

https://businessvic.secure.force.com/GrantsPortalLogin

Next steps

Alex Stewart is contacting existing clients to discuss their situation and how they will benefit from this grant. Unlike past state grants, Sam Della Bosca can’t apply on your behalf but she will guide applicants through the process.

By way of closing comment, please don’t let this opportunity slip by. Every small business should undertake these qualifying activities. And now that the troubling days of 2020 and 2021 are behind us, this gives you the chance to undertake proper planning for the future.

Are your PAYG or GST Instalments too high?

Quarterly BAS’s for the June 2022 quarter that contain GST or PAYG Instalments are due for lodgement this Thursday.

If your instalments for the year including June’s is close to the year’s actual liability then no action is required.

If either instalment is less then you will be asked to pay the shortfall by the time the 2022 Tax Return is lodged. You can though increase your June quarter instalment if you wish to not be sitting on the cash until May next year. This may also suit you if you are worried about not having the required funds when the shortfall(s) falls due.

But what if either instalment for June will take you well over what you are required to pay for the year?

If you do pay it, then it is not the end of the world as any excess amount will be refunded to you when the 2022 Tax Return is lodged. But why drain your funds in the meantime?

You are entitled to amend the instalment as issued by the ATO. But don’t get too carried away as the ATO does have the power to fine for gross under-estimates.

Do you think your instalments are too high? This is just one of the 67 items we address when undertaking pre year end reviews. So, if you are a client of ours then take comfort that we have already addressed this. If you are not a client, then we welcome a discussion.

I take the opportunity to state that the ATO has resumed normal operations. Since covid broke, they have not been chasing debts and lodgements. That has all changed as evidenced by the volume of letters and demands issued by the ATO since June. We have even heard of the ATO issuing Director Penalty Notices (DPN’s) to directors. DPN’s can be issued where a BAS obligation remains unreported and unpaid for more then 3 months. The scary part is that once issued, basically speaking, the only way to clear your now personal tax debt is to pay the tax due. Please don’t hesitate to call us if you are concerned about any request by the ATO.

June quarter employer obligations

There are a number of important employer obligations that you will need to satisfy by 28th July.

Whilst 28th July is the end date for paying the June quarter SG super, payments through clearing houses can take up to 6 to 10 days. We therefore recommend that you pay your June quarter super today if you have not done so already.

Those larger employers that are subject to Pay-roll Tax are due to certify the 2021/22 remuneration by 21st July. One needs to be careful as in addition to wages, salaries, commissions, directors fees, bonuses and so on, Pay-roll tax is also payable on:-

- Superannuation

- Some fringe benefits

- Payments to certain contractors (including some corporates).

Although you may have a WorkCover lodgement date as late as March next year, it would also be prudent to certify your 2021/22 WorkCover remuneration now.

We take this opportunity to remind you that 14th July was the due date for Single Touch Payroll finalisations (with extended dates for closely held employees).

We welcome any question you may have about these matters.

2022 tax planning tips

With 30th June fast approaching, here is a list of common tax planning strategies that we have been discussing with clients:-

- Prepaid revenue can be deferred to the extent that it relates to next financial year and where a customer has the contractual right to cancel the contract at any time.

- Buying items such as stationery, printer cartridges, stamps, etc by Thursday 30th Those of you who entered the Simplified Tax System (STS) by 30th June 2005 (who are therefore automatically assessed on a cash basis) may wish to pay any bills not due until July like your phone bill, rent, printing and stationery, etc. Paying your accounting fees is also recommended!

- STS taxpayers are now known as Small Business Taxpayers (SBTs). SBTs now include taxpayers with an annual turnover under $50,000,000.

- As we have previously highlighted, SBTs can claim a full deduction of any assets acquired. But they must be in your possession ready to use. And if this means installation, then it must be installed before July.

- For more on the instant asset write-off, refer to recent blogs titled Parts 1, 2 and 3.

- SBT taxpayers can also claim a full deduction for payments such as insurances, rent and the like which cost more than $1,000 even though the service period runs past 30thJune and into the next financial year.

- For those of you who receive this e-mail that are employees or rental property owners, you can claim a complete write off for assets costing less than $300.

- If a property is jointly owned, then you can claim the full cost of assets costing less than $600 (meaning you claim less than the $300 limit each).

- Investors can claim prepayments in full. An investor with a property or share loan can claim a deduction for 12 months prepaid interest. Please note that the ATO requires that for the prepayment to be claimed, one must benefit through a lower interest rate (for which you need to keep proof).

- For those who have already generated a large capital gain, consideration should be given to selling other investments that have an unrealised capital loss. Those with no or minimal employer SGC support could consider making a deductible contribution into superannuation to offset the tax on the capital gain (but speak to a financial planner first).

- If you are about to sell an asset which will generate a capital gain, consideration should be given to selling it after 30th This will defer the payment of any capital gains tax liability until as late as early June 2024.

- Companies can accrue a director’s fee which is not payable until the following financial year. Why? – the company gets a deduction in this financial year but the director is not assessed on the income until the following financial year in which it is received. The trick is to document it correctly.

- If you have stock, count it (a separate e-mail will be sent to business clients with stock). As stock can legally be valued differently from item to item and from year to year, it can result in some advantageous outcomes.

- Donations are deductible. It must be a genuine donation so you can’t receive anything in return. Raffle tickets can’t be claimed.

- Our tax planning checklist also considers other items such as writing off bad debts, making Division 7A loan repayments, whether a company can reclaim past tax payments under the loss carry back rules, distributing to a new beneficiary and varying PAYG Instalments. How these and other opportunities are employed depends on your circumstances. We identify what you can do by running through our 67 point checklist.

All of the above tax planning tips are explained to our clients in any easy to read Tax Planning Report. And to give you more control over your cash flow, that report also sets out your income tax payments for the next 12 months.

We welcome any query about these tax planning tips.

We end this blog by taking the opportunity to remind you of:-

- The need for those who were directors before November 2021 to apply for their Directors Identification Number by early October at the absolute latest.

- Single Touch Payroll reporting fields will greatly expand under what is called STP2 and there is much preparatory work to be undertaken. And with STP2 now to be shared with Fair Work Australia, you don’t want to be getting it wrong! We encourage you to adopt the new system as soon as possible as any extension only causes more work later. Please let us know if you would like a referral to a payroll expert.