Posts Categorized: News

Why is the ATO suddenly asking you for money?

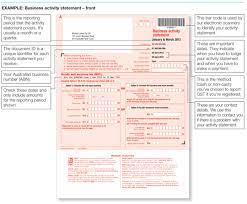

If you want someone to pay you then it is a good idea to send them a bill so they can. Seems like common sense – but not to the ATO.

A number of clients have been surprised, offended and/or doubtful of recent payment requests from the ATO. This happened as the ATO elected to cease sending paper activity statements. It seems as though many did not receive a reminder through their MyGov account – or if they did, ignored it legitimately thinking it was a scam.

So will you get into trouble?

The answer is no.

We understand that the ATO will revert to issuing paper statements.

We do though recommend periodically checking your MyGov account just in case you have missed something. Once you have opened a My Gov account, they will no longer issue you with a physical assessment notice; even we aren’t issued with one. They also cease issuing super S293 notices and the like.

But never click on a link within a MyGov email as it may well be a hoax. Log in separately from your internet browser.

Why getting your FBT exposure right is so critical

So why getting your FBT exposure right so critical?

Before we answer that question, I will answer the base question of what is a fringe benefit. A fringe benefit is anything provided by an employer to an employee other than by wage/salary and super.

As such it includes such things as:-

-

Passenger cars

- Car parking

-

Entertainment

-

Selling firm’s goods at a discount

-

Providing accommodation

-

Paying any employee bill whether that be school fees, mortgage, health club membership and so on.

And this leads to the understanding of how to address your FBT exposure which can be summarised as:-

-

Determine whether you the employer are exempt (charities, public hospitals) or subject to a reduced rate (private schools).

-

Determine what fringe benefits you have provided to whom

-

Assess whether an exemption or concession applies to that type of benefit. There are some special rules which benefit small businesses.

-

Calculate the taxable value

-

Then, and this what most people get wrong, determine whether the employee is better off making a contribution to reduce the fringe benefit rather than pay FBT tax (which is equivalent to the highest marginal tax rate).

-

Prepare and lodge the FBT Tax Return.

The reality is that all too many employers get this wrong as the ATO is successful in making an adjustment in 50% of FBT audits. That’s every second audit!

And don’t think the ATO doesn’t think this is a big audit target. One recent project was their recording the number plates of all utes parked at an AFL game at the MCG. Those plate numbers registered to companies were then cross matched with lodged FBT and Income Tax Returns. The ATO had a field day.

So what should you do?

Well for our clients we run through a checklist to make sure all benefit s provided are identified. We will then work through (a) quantifying the benefit before (b) determining the most efficient manner of dealing with the benefit and then (c) lodge an FBT Return (we do this even if the taxable value has been reduced to nil as the ATO have therefore issued an assessment and then only have two years to audit.

And with that I return to the question of why is getting your FBT exposure right is so critical? As you will now be able to appreciate there is more than answer to this question:-

-

It is a key ATO audit area.

-

If it is wrong in one year, the ATO will start auditing all years.

-

With the FBT tax rate being the equivalent of the highest marginal tax rate, the tax can be significant.

-

The ATO readily applies both interest and penalties.

-

The audit clock will start clicking once an FBT Tax Return sis lodged – after that the ATO can’ t go back further than 2 years.

Do you have any questions? We would welcome the opportunity to discuss them with you.

JobKeeper reminder & reality check

We will start with an important reminder to meet your turnover reporting obligation in order to receive your February JobKeeper entitlement by this coming Friday. This means you have to report the actual GST turnover for the month of February and what you think it will be for March.

And with JobKeeper due to conclude with the fortnight ending 28th March, this is the second last time you or your accountant will need to complete this task.

The bigger issue though on the horizon is what happens when JobKeeper ends?

Whilst the drop in the unemployment rate and growth in the GDP rate have been welcome, come April small businesses will be on their own. There is no (as yet but will there be?) targeted assistance to those industries decimated by covid.

So the four biggest questions you face are?

-

How will your business survive?

-

How will the businesses of your customers and suppliers survive?

-

And have you, your customers and suppliers addressed the impact of the end of rental relief? And not only may you soon be paying full rent, what about the portion of relief that was deferred?

-

And are your financiers going to continue to support you?

And with cash flow being the life blood of any business you need to understand what the impact starting in as soon as 3 weeks. Some accounting software providers market their cash flow capabilities, but it is very simple and for the immediate short term.

We however have advanced software which can:-

-

Model out various post 28th March scenarios.

-

Show the cash flow peaks and troughs in the months ahead.

And with our many years of collective experience of working with all sorts of industries, we are able to provide recommendations as to how to rectify and improve what is predicted to unfold.

Our first meeting with clients is free of cost or obligation and we welcome your call.

Am I paying the right award wage?

Awards set out employment conditions and minimum pay rates.

There are over 100 industry based awards and they cover most workers in Australia. That said, whilst financial planners come under an award, accountants don’t; but some workers within an accounting firm may come under an office award depending their duties.

Larger employers with a registered agreement in place have the terms of that agreement over-rule any award(s) that may otherwise be applicable.

Awards can also determine what the default super choice fund. No wonder industry super funds have go to be so big!

So with all this complexity it’s important to make sure you pay under any applicable award. But how do you do that?

You can find a list of awards at – https://www.fairwork.gov.au/awards-and-agreements/Awards/list-of-awards

Better yet, you can see what awards that may relate to your employees at Fair Work Australia’s award checker – https://www.fairwork.gov.au/awards-and-agreements/awards/find-my-award/ Please also refer to clause 4 as that is usually the clause that sets out who is covered by the award. You can also check the most important job classifications which can usually be found within the pay clause or a schedule.

Can you benefit from the new Vic Govt support package?

Yesterday the State Government announced its Circuit Breaker Action Business Support Package.

Unlike past support packages, there is no general entitlement.

The relief is targeted to industries most affected but the snap lockdown:-

-

Licensed hospitality venues who have already received a grant through the Licensed Hospitality Fund will be entitled to a $3,000 grant.

-

Accommodation Support Program has two tiers of funding ($2,250 and $4,500) dependent on the number of cancelled nights. It is an expansion of the existing Regional Tourism Accommodation Support Program and also includes greater Melbourne.

-

An expansion of the Travel Voucher Scheme. A further 10,000 regional vouchers will be issued as well as 40,000 travel vouchers for greater Melbourne.

There will also be a Business Costs Assistance Program for those with annual payroll under $3,000,000. Full details are yet to be released.

You can register your interest in applying for the Victorian Accommodation Support Program at https://www.business.vic.gov.au/support-for-your-business/grants-and-assistance/circuit-breaker-action-business-support-package/victorian-accommodation-support-program

You can read more at https://www.business.vic.gov.au/support-for-your-business/grants-and-assistance/circuit-breaker-action-business-support-package

We welcome any question you may have.

Reducing the tax on Christmas

Entertaining and providing gifts at Christmas time to staff, customers and suppliers is a cost of doing business. However, there are some important FBT, GST and income tax considerations and outcomes.

As an employer, you need to be careful at what you provide at Christmas. The rules are complex and the costs of getting it wrong can prove very expensive.

We will outline some of the more common scenarios and what to be careful of.

Under-pinning the implications are the following key points:-

-

Christmas parties, entertainment and gifts are all treated under entertainment tax rules.

-

FBT applies to benefits given to employees.

-

There are no FBT implications on entertainment and gifts given to customers, clients and suppliers.

-

There are three methods under which an employer can quantify the taxable components of any entertainment expenditure – in fact there are 38 permutations depending on who is entertained where, how and with whom. We will largely address the actual method which is the one used by most small businesses (as it usually results in the best outcome). It is beyond the scope of this briefing to address the 12 week log method and we will only touch upon the 50/50 method where relevant.

-

Christmas comes but once a year and to the best of my knowledge and experience does so on 25th December. Nevertheless, the ATO treats Christmas parties and gifts as being what are called minor, infrequent and irregular benefits.

-

Such minor benefits are FBT exempt where they cost less than $300 (including GST) provided the actual method is used to quantify entertainment.

The Christmas party

Where entertainment is calculated under the actual expenditure method (which is the most common method for small businesses):-

-

If a Christmas party is held on-site on a work day, the whole cost for each employee will be an exempt fringe benefit. So too will the spouse’s cost provided the cost per spouse is less than $300. No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend. Taxi travel to or from the workplace (not both ways) will be exempt from FBT and not tax deductible.

-

If a Christmas party is held off the work premises, then the whole cost will be exempt from FBT provided the party costs less than $300 per person (employees and their spouses). No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend.

-

If an external Christmas party costs more than $300 or more per person then the total cost is subject to FBT.

-

The cost of any entertainment provided during the party (whether that be at the work premises or outside) will be exempt if it costs less than $300 per head – for example a DJ, musician, clown and comedian.

-

The cost of entertaining clients, customers and suppliers is not subject to FBT and is not tax deductible.

-

If any exemption is exceeded then FBT is payable. Consequently, an FBT Tax Return must be lodged and FBT paid (the FBT tax rate being the same as the top marginal tax rate). Please keep this in mind when completing the 2018/19 FBT Questionnaire in early April 2019.

-

All other entertainment during the year will be subject to FBT on a case by case basis.

Where entertainment is calculated under the 50/50 method:-

-

50% of the cost will be subject to FBT and this portion will be tax deductible. The other 50% will not be subject to FBT and will not be tax deductible. An FBT Tax Return must be lodged and FBT paid.

-

Only taxi travel from home to the venue will be FBT exempt and not deductible for tax.

-

50% of all other entertainment during the year will be subject to FBT.

Gifts

The following gifts are exempt from FBT and are tax deductible:-

- Hampers, bottles of wine, gift vouchers, a pen set costing less than $300 (inclusive of GST).

The following gifts are subject to FBT and are not tax deductible:-

- Tickets to a sporting event or theatre, holiday, accommodation, etc.

The GST treatment of gifts is:-

- The GST component of any tax deductible portion can be claimed back.

- The GST component that relates to the non tax deductible portion can’t be claimed.

Please do not hesitate to call us should you have any queries.

Can your business benefit from JobMaker

JobMaker is an additional incentive which was announced in the October Federal Budget. Employers will be paid a generous incentive which take on additional young employees between October 2020 and October 2021.

JobMaker payments will be paid quarterly and will start from February.

Payments will made for up to 12 months from an employee’s start date. This means entitlements run through to September 2022 for those employees employed as late as September 2021.

Registrations opened on 7th December and you need to be registered by 30th April. Those employers who would have been entitled to claim JobMaker will miss out on 3 months of payments if not registered by then. That could be as much as $2,600 per qualifying employee!

Registered employers will receive:-

-

$200 per week for each eligible employee aged between 16 and 29

-

$100 per week for each eligible employee aged between 29 and 35

JobMaker is not available to employers who are receiving JobKeeper.

To qualify, employers must:-

-

Have an ABN

-

Up to date with tax lodgements

-

Registered for PAYG WH

-

Be reporting through Single Touch Payroll

-

Have employed an additional employee – and not just replaced one employee with another

- Had an increase in the payroll amount.

Qualifying employees must have been in receipt of JobSeeker, Youth Allowance or Parenting Payment for at least one month of the three months preceding their being employed. They must also have worked an average of 20 hours per week.

There are many other criteria and considerations. Please fill in the contact form if you would like a copy of our JobMaker white paper.

We welcome any questions you may have.

And like JobKeeper you have to register to receive anything so don’t let this opportunity, or moreover the money, pass you by.

Main outtakes from Victorian State Budget

During the week the Victorian State Government handed down is budget.

It has been pitched as an incentive budget. Most of the breaks go to property. In part this is not surprising given its political appeal and that it has a great multiplier effect through the economy.

Property incentives:-

-

50% reduction in Stamp Duty for the acquisition of newly constructed property costing up to $1,000,000.

-

25% reduction in Stamp Duty for the acquisition of existing property costing up to $1,000,000.

-

This reduction is additional to the first home buyers concession.

-

And we remind you that there is also the previously announced 50% Stamp Duty reduction on the purchase of commercial properties.

-

Also announced was a 50% Land Tax discount for build to rent developments.

Pay-roll Tax relief:-

-

Employers with remuneration under $10,000,000 will receive a 10% credit for the 2020/21 and 2021/22.

-

From 2021/22, the monthly payment threshold will increase from $40,000 of pay-roll tax to $100,000.

-

There will also be 10% credit (capped at $10,000) for those employers who increase their wages by $100,000 during 2020/21 and/or 2021/22.

-

Unfortunately the threshold in Victoria will remain at $650,000. All other Victorian states and territories have thresholds of $1,000,000 to $2,000,000 before they levy Pay-roll Tax. This seems a significant disincentive to employ in Victoria, particularly for those Murray River border towns.

We welcome any question you may have about the State Budget or any other matter.

A warning on interest rates

With a further fall of the official interest rate, interest rates paid to investors have fallen again.

Term deposit rates are pitiful. Not only are they low, they are pretty much half of the current inflation rate. What that means is that in real terms, balances are going backwards.

But what is really scary is what interest rates are being paid on “investment” accounts.

We have recently seen examples where clients are earning nothing (like zero) on account balances up to $250,000. Sometimes this has been missed by a client as there had been, until recently, a decent interest rate paid. Sometimes it has been missed due to a bank publicising the headline interest rate for balances over say $500,000.

But beware if chasing higher interest rates. If someone is paying over the odds, then tread carefully. Very carefully. Often it means the investment is risky. So is an extra % or two really worth the risk of losing your hard earned dollars?

Are you missing out on the Family Tax Benefit?

The Family Tax Benefit is designed to support low and middle income with the cost of raising a family. It is not only a generous payment, it is non-taxable – meaning you get to keep the lot.

So generous that they must be taken into account when undertaking any tax planning.

There are two Family Tax Benefit components:-

-

Part A is based of combined family income.

-

Part B is based of the secondary earner’s income (but the main income earner’s income must be below $100,000).

Part A is paid in graduated levels:-

-

The full amount per child is paid where the combined family income is under $55,626.

-

For every dollar of income over $55,626, the Part A entitlement is reduced by 20 cents until it reaches what is called a base rate.

-

Families are paid the base rate until combined income exceeds $98,988. Every extra dollar of income then reduces the benefit by 30 cents in the dollar until any entitlement is exhausted.

-

The maximum payment rates are $4,929pa for each child under 13, $6,410pa for children aged between 13 and 15 and the same rate for children aged between 16 and 19 who meet study requirements.

-

The base rate is $1,583pa.

Part B is paid in respect of one child only:-

-

Is paid at $4,190pa where the youngest child is under 5.

-

Is paid at $2,927pa where the youngest child is aged 5 to 18.

-

After the first $5,767 of annual income of the secondary income earner, the rate of payment is reduced by 20 cents for extra dollar of income.

-

This means that no entitlement is paid where the youngest child is under 5 and the secondary income earner’s income exceeds $28,671; $22,388 for youngest child being 5 and over.

Payments can be received either fortnightly or after lodgement of your Tax Return for that year. But a Tax Return must be lodged by the following 30th June otherwise all entitlements are denied.

The amounts payable can be substantial. They can mean that a two child family can effectively be paying no income tax on incomes of $60,000.

A lack of proper planning by your accountant could see a loss of not just of tax of 39% but may be 30% of a Part A entitlement and even all of the Part B entitlement. As they say, proper planning prevents poor performance!

If your accountant hasn’t spoken to you about the Family Tax Benefit then you could be missing out on many thousands of dollars. We welcome the opportunity to discuss your situation.