Posts Categorized: Tax

Are there new beneficiaries to distribute to?

In our last tax tip, we outlined distributing to bucket companies.

But may you not need to.

Perhaps there are people within your family group that your family trust can distribute to for the first time. And the most obvious case is a child within the ancestral line who has turned 18 during the year.

If so, the trustee of your family trust could distribute up to the tax free threshold (adjusted for the Low Income and Low Middle Income Tax Offsets).

But beware as:-

-

The trust’s definition must not be narrow enough to exclude the newly turned 18 year old.

-

If the family trust has previously made a Family Trust Election (now there is a major topic in itself) that election may not include the newly turned 18 year old within the permitted family group.

-

It may be that the income distributed may upset some social security claim.

And don’t forget, any new adult beneficiary must be reported to the ATO before the end of July.

As is always the case with proper tax planning, there is much to consider.

Should you use a bucket company?

Should you use a bucket company is a common question at this time of year.

Trusts are great for asset protection and flexibility. However, all income must be distributed (be taxed in someone else’s name). And if the profits are large, then family members might be paying a lot of tax at 39% and 47%.

If the profits aren’t needed, then bucket companies can be attractive. Whatever business income is distributed to the bucket company only gets taxed at 26% (25% next year). That in itself can be a compelling reason. So for this tax year, distributing $200,000 to a bucket company could save you up to $42,000.

The modern problem is what is the company going to do with the money as :-

-

If it is invested in cash it won’t make 1%.

-

If the company invests in appreciating assets then there is no CGT discount.

-

If you take the money then you will pay tax at your marginal tax rate less the prevailing company tax rate. That said, this isn’t such a problem if you are approaching retirement.

So bucket companies, whilst suitable for some, aren’t suitable for all.

And it must also be noted that you can’t assume you can add a bucket company to your group. You need to check whether the trust deed permits it.

Not that it is necessarily the case, but the above concerns in your case might mean it is better to consider a re-structure. We welcome the opportunity to discuss your situation with you.

How not pay tax on the Cash Flow Boost

Whilst JobKeeper got all the press, the Cash Flow Boost played a huge part in enabling employers to retain their workforce.

The Cash Flow Boost was poorly named. No cash was given to employers. Rather employers received a credit on the March to September 2020 activity statements. The credit was a least $20,000. Employers with larger payrolls received up to $100,000 credit off their PAYG Withholding liability.

But it was worth more than that.

It is what is called non-assessable non-exempt income. In other words, no income tax was payable on the receipt of the credit on the activity statements lodged in the 2019/20 year. Same for the Cash Flow Boost applied to the activity statements lodged in this financial year.

But that is not the end of the story. And the next part is not as palatable for some. There are three main scenarios:-

-

Sole trader employers retain the money tax free.

-

Companies will have the untaxed Cash Flow Boot form part of their retained earnings. That means when later paid out as a dividend, there will be no proportional tax credit to attach that dividend. Effectively, it results in what is called an unfranked dividend. It means an individual shareholder will pay tax on the full amount of the Cash Flow Boost that they proportionally receive.

- And the typical family trust -well it depends. If the trust deed allows for different forms of income to be identified and streamed to individuals, then it comes out tax free. If not is taxable.

In respect of trusts this should not be news. Last year, we had a tax lawyer review our client’s trust deeds to ensure the Cash Flow Boost was treated as it was intended; as tax free income.

Was this handled properly for you last year? Are you at risk of paying tax on the Cash Flow Boost your trust received this financial year? Time to make sure – call us.

Be careful when claiming bad debts

A bad debt can be claimed as a tax deduction. And with the end of financial year rapidly approaching, now is the time to determine what can be written off.

Probably the more important discussion is how to avoid bad debts in the first place. That will be left to a future post.

To claim a bad debt, it must have already been reported as income. That means those who report their income for tax purposes on a cash basis can’t claim a bad debt.

So for those who recognise income on an accruals basis – meaning income is recognised when the invoice is raised – they must have reached a position where all reasonable attempts to collect have failed. It must therefore be more than doubtful.

You then need to make an entry into your accounting system. Those who are using a cloud file must process the bad debt in June. Don’t fall for the trap of ding it later as cloud systems time date entries.

But what if I collect the money later?

There are genuine cases where this happens. The customer could come into money through an inheritance or windfall and do the right thing and pay back their creditors. In that case, you re-recognise the income as a bad debt recovered.

Beware of schemes of arrangement

Sometimes a business may not write off a debt but later accept so many cents in the dollar from a liquidator’s offer. The problem here that accepting say 40 cents in the dollar does not entitle you to claim the other 60% as a bad debt. So keep on top of your customers and ensure you write off bad debts as soon as you can.

Tip

It is always a good idea to document the attempts you have made. That way you will have some contemporaneous evidence as to your decision if the ATO start asking questions.

As I already said, the real question is what can you do to prevent bad debts in the first place – we welcome that discussion with you.

Instant asset write-off warning

The Instant Asset Write-Off is a great way to reduce both your 2021 tax liability and your 2021/22 PAYG Instalments. And you won’t drain you cash flow if you finance the asset purchased.

But beware!

To be able to claim the write off in the 2021 tax year, you must have the asset installed and/or ready for sue before July.

If the car you ordered is not delivered until July then you won’t be able to claim until next tax year.

And as a footnote to the above, financing a lease will not able you to claim the write-off. Under a lease, you are not the owner until you pay the final instalment. This is just another trap.

If you want to know more then call us.

What’s in the Budget for you?

What’s in the Budget for you?

Probably significantly more than you think.

As what is now unfortunately the norm, there were plenty of pre-announcements before Budget night. But there is much more to the Budget that was announced on Budget night or leading up to it.

In addition to some key business announcements (extension of loss carry back company rules and instant asset write-off) there were very welcome announcements to being able to getting more money into super. Welcome I say as how can one provide for retirement with a contribution cap – which currently sists at $25,000 before being eroded by 15% tax, life insurance premiums and for some an extra 15% tax).

Also of note were the proposed changes to personal and self managed super fund residency rules. I say welcome as the existing rules are quiet archaic in context of how people today live, work and travel – mind you we still aren’t going anywhere for a while with covid.

We will explore some of the key measures in our next survive and thrive webinar. It will beheld at 5.30pm on Wednesday 2nd June and you can book here – https://tinyurl.com/reg0206

We will also flesh out some opportunities in upcoming blogs.

But having said all that, please keep in mind that:-

-

A Budget is only ever a series of announcements,

-

They still have to be legislated,

-

They may be changed slightly and

-

Many have start dates form July 2021 – and we may have a change of government before then.

Please though don’t hesitate to call us if you any questions.

Entertainment can be taxing

Entertainment can be taxing. That’s an understatement as there are 3 aspects – tax deductibility, GST and Fringe Benefits Tax (FBT). There are 38 outcomes depending on who does with whom where and why. It therefore requires careful analysis

No wonder the ATO has such a great strike right in FBT audits on entertainment.

But that’s not all that has to be considered. For FBT purposes, an employer has to determine which of three methods produces the best result. Although that said, the actual method for quantifying the FBT taxable value of entertainment is usually best for small employers (but not always!).

You can read more on the following factsheet – FBT Flyer – Meal Entertainment Factsheet

Confused or concerned? That’s understandable. We would be happy to discuss your situation.

We take this opportunity to state that the prudent action is to lodge an FBT Tax Return – even if nothing is payable (which is usually the case for small businesses). This extra step is not a waste of time nor money as it starts the audit clock ticking – after 3 years the ATO can’t go back and audit you; don’t lodge an FBT Tax Return and the ATO can go back as far as they like.

Why is the ATO suddenly asking you for money?

If you want someone to pay you then it is a good idea to send them a bill so they can. Seems like common sense – but not to the ATO.

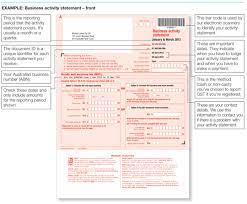

A number of clients have been surprised, offended and/or doubtful of recent payment requests from the ATO. This happened as the ATO elected to cease sending paper activity statements. It seems as though many did not receive a reminder through their MyGov account – or if they did, ignored it legitimately thinking it was a scam.

So will you get into trouble?

The answer is no.

We understand that the ATO will revert to issuing paper statements.

We do though recommend periodically checking your MyGov account just in case you have missed something. Once you have opened a My Gov account, they will no longer issue you with a physical assessment notice; even we aren’t issued with one. They also cease issuing super S293 notices and the like.

But never click on a link within a MyGov email as it may well be a hoax. Log in separately from your internet browser.

Reducing the tax on Christmas

Entertaining and providing gifts at Christmas time to staff, customers and suppliers is a cost of doing business. However, there are some important FBT, GST and income tax considerations and outcomes.

As an employer, you need to be careful at what you provide at Christmas. The rules are complex and the costs of getting it wrong can prove very expensive.

We will outline some of the more common scenarios and what to be careful of.

Under-pinning the implications are the following key points:-

-

Christmas parties, entertainment and gifts are all treated under entertainment tax rules.

-

FBT applies to benefits given to employees.

-

There are no FBT implications on entertainment and gifts given to customers, clients and suppliers.

-

There are three methods under which an employer can quantify the taxable components of any entertainment expenditure – in fact there are 38 permutations depending on who is entertained where, how and with whom. We will largely address the actual method which is the one used by most small businesses (as it usually results in the best outcome). It is beyond the scope of this briefing to address the 12 week log method and we will only touch upon the 50/50 method where relevant.

-

Christmas comes but once a year and to the best of my knowledge and experience does so on 25th December. Nevertheless, the ATO treats Christmas parties and gifts as being what are called minor, infrequent and irregular benefits.

-

Such minor benefits are FBT exempt where they cost less than $300 (including GST) provided the actual method is used to quantify entertainment.

The Christmas party

Where entertainment is calculated under the actual expenditure method (which is the most common method for small businesses):-

-

If a Christmas party is held on-site on a work day, the whole cost for each employee will be an exempt fringe benefit. So too will the spouse’s cost provided the cost per spouse is less than $300. No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend. Taxi travel to or from the workplace (not both ways) will be exempt from FBT and not tax deductible.

-

If a Christmas party is held off the work premises, then the whole cost will be exempt from FBT provided the party costs less than $300 per person (employees and their spouses). No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend.

-

If an external Christmas party costs more than $300 or more per person then the total cost is subject to FBT.

-

The cost of any entertainment provided during the party (whether that be at the work premises or outside) will be exempt if it costs less than $300 per head – for example a DJ, musician, clown and comedian.

-

The cost of entertaining clients, customers and suppliers is not subject to FBT and is not tax deductible.

-

If any exemption is exceeded then FBT is payable. Consequently, an FBT Tax Return must be lodged and FBT paid (the FBT tax rate being the same as the top marginal tax rate). Please keep this in mind when completing the 2018/19 FBT Questionnaire in early April 2019.

-

All other entertainment during the year will be subject to FBT on a case by case basis.

Where entertainment is calculated under the 50/50 method:-

-

50% of the cost will be subject to FBT and this portion will be tax deductible. The other 50% will not be subject to FBT and will not be tax deductible. An FBT Tax Return must be lodged and FBT paid.

-

Only taxi travel from home to the venue will be FBT exempt and not deductible for tax.

-

50% of all other entertainment during the year will be subject to FBT.

Gifts

The following gifts are exempt from FBT and are tax deductible:-

- Hampers, bottles of wine, gift vouchers, a pen set costing less than $300 (inclusive of GST).

The following gifts are subject to FBT and are not tax deductible:-

- Tickets to a sporting event or theatre, holiday, accommodation, etc.

The GST treatment of gifts is:-

- The GST component of any tax deductible portion can be claimed back.

- The GST component that relates to the non tax deductible portion can’t be claimed.

Please do not hesitate to call us should you have any queries.

Are you missing out on the Family Tax Benefit?

The Family Tax Benefit is designed to support low and middle income with the cost of raising a family. It is not only a generous payment, it is non-taxable – meaning you get to keep the lot.

So generous that they must be taken into account when undertaking any tax planning.

There are two Family Tax Benefit components:-

-

Part A is based of combined family income.

-

Part B is based of the secondary earner’s income (but the main income earner’s income must be below $100,000).

Part A is paid in graduated levels:-

-

The full amount per child is paid where the combined family income is under $55,626.

-

For every dollar of income over $55,626, the Part A entitlement is reduced by 20 cents until it reaches what is called a base rate.

-

Families are paid the base rate until combined income exceeds $98,988. Every extra dollar of income then reduces the benefit by 30 cents in the dollar until any entitlement is exhausted.

-

The maximum payment rates are $4,929pa for each child under 13, $6,410pa for children aged between 13 and 15 and the same rate for children aged between 16 and 19 who meet study requirements.

-

The base rate is $1,583pa.

Part B is paid in respect of one child only:-

-

Is paid at $4,190pa where the youngest child is under 5.

-

Is paid at $2,927pa where the youngest child is aged 5 to 18.

-

After the first $5,767 of annual income of the secondary income earner, the rate of payment is reduced by 20 cents for extra dollar of income.

-

This means that no entitlement is paid where the youngest child is under 5 and the secondary income earner’s income exceeds $28,671; $22,388 for youngest child being 5 and over.

Payments can be received either fortnightly or after lodgement of your Tax Return for that year. But a Tax Return must be lodged by the following 30th June otherwise all entitlements are denied.

The amounts payable can be substantial. They can mean that a two child family can effectively be paying no income tax on incomes of $60,000.

A lack of proper planning by your accountant could see a loss of not just of tax of 39% but may be 30% of a Part A entitlement and even all of the Part B entitlement. As they say, proper planning prevents poor performance!

If your accountant hasn’t spoken to you about the Family Tax Benefit then you could be missing out on many thousands of dollars. We welcome the opportunity to discuss your situation.