Posts Categorized: Tips of the week

What is the depreciation limit?

What is the depreciation limit is a very good question as it has unclear for too long.

It was all clear after 30th June 2023 that the instant asset write-off provisions for small businesses had ended. It was great whilst it lasted (but noting the flip side that the proceeds from selling car fully written off are now fully assessable).

The depreciation limit for 2023/24 was up in the air for far too long. Unfortunately the proposed amendment of a $30,000 limit was not passed. So the depreciation limit for 2023/24 is $20,000 – to read about tips and traps about the $20,000 limit, please refer to our earlier blog at – https://www.mrsaccountants.com.au/asset-depreciation-claims-for-2023-24/

So what is the depreciation limit for 2024/25?

$20,000.

Who can claim these depreciation rates?

These limits are available to businesses (whether operated via a company, trust or partnership or as a sole trader in one’s own name).

The $20,000 limit also applies to an opening pool

Small businesses who have elected to use the pooling depreciation system with its high depreciation rate can also claim the pool balance when it falls below $20,000. That is defined as being:-

- The opening balance of the pool

- Plus the taxable portion of acquired assets

- Less the taxable portion of assets sold during the year.

So if your business bought an asset costing say $22,000 ex GST in 2023/24, then the opening balance of $18,700 can be written off in full in 2024/25 (assuming no other assets acquired or disposed of).

It is beyond the scope of this article to run through all the rules but please keep in mind that you can only claim depreciation from when an asset is installed and ready for use.

Please don’t hesitate to contact us if you have a query.

Can I deduct the cost of charging my electric vehicle?

This has become a common tax question. And the answer is it depends whether you can deduct the cost of charging your electric vehicle.

No claim is available if you claim work car expenses under the cents per kilometre method. That is because the per kilometre rate takes into account charging costs.

Electric charging costs can be claimed at the rate of 4.20 cents pkm where:-

- Claiming car expenses under the log book method.

- Motor vehicle expenses for vehicles that are not a car (such as a one-tonne ute).

To qualify to use this rate you must satisfy the following three conditions:-

- The car or vehicle is a zero emissions vehicle. It is important to note that hybrid vehicles are not zero emission vehicles.

- You must have incurred electricity costs at home.

- You have kept relevant records.

There are 3 relevant records to keep:-

- A valid log book.

- Opening and closing odometer readings.

- An electricity bill (with proof of obligation to pay if in a shared house).

What if I charge my vehicle out of home?

Thankfully the ATO have dropped their initial harsh stance of not allowing such claims.

To be able to claim such costs, the vehicle must have functionality that accurately reports the percentage of a vehicle’s total charge based on the charging location. One is then to adjust the home charging percentage adjusted accordingly.

If your electric vehicle doesn’t identify charging by location then one can only claim either:-

- The home charge at 4.2 cents pkm or

- Commercial charging charge costs.

But not both.

We hope this charges up your tax claim – but please contact us if you have any queries.

Correctly claiming your home office expenses

With the start of a new financial year it is timely to explore how to correctly claiming your home office expenses.

Can I claim home office expenses?

Yes you can if:-

- You are undertaking genuine employment related activities, or

- Home is your sole base of operations (which includes employees who are not provided with an office, or

- You are carrying on a business from home.

What can home office expenses can I claim?

You can claiming running costs such as:-

- Heat, light and power

- Phone expenses

- Internet

- Consumables such as computer supplies and printing & stationery items

Those who run a business from home or it is their sole base of operations can also claim occupancy costs.

How can I quantify my claim?

There are two available methods:-

- Fixed rate method

- Actual expenses

How does the fixed rate method work?

Under this method, one claims 67 cents for every hour worked at home. Occasionally checking emails doesn’t is not sufficient to allow a claim.

To qualify to sue this method you must incur at least one of the following expenses:-

- Electricity or gas for heating and/or cooling or to power equipment.

- Internet

- Mobile or home phone

- Printing and stationery.

Receipts must be kept to evidence one or more of these costs have been incurred.

And additional to this claim is the depreciation of any home office work items.

TRAP Irrespective of how much you may genuinely use your mobile away from your home office, you will not be able to make a separate claim for using that mobile.

TIP You don’t need to have a set aside office only used for work purposes. You just need a dedicated area.

TIP Once can also claim for hours worked at a holiday home (provided above criteria satisfied).

What records do I need to keep under the cents per hour method?

In addition to the receipts above, as we have highlighted in past posts and Tax Return covering letters, you have been required since February 2023 to log every hour worked at home.

TIP As stated above, you can only claim hours you have logged. You can download a spreadsheet below that is set to track very hour worked at home.

TIP We recommend downloading the spreadsheet below and saving it in the middle of your desktop or laptop – that way you won’t forget to log the hours as you work them.

You can download the home office cents per hour method by clicking here – 2024-25-Home-Office-Expenses-hours-worked-log

What is included within an occupancy home office expenses claim?

One first measures and calculates the area that is used for work/business purposes.

The work/business area % is then applied to:-

- Heat, light and power costs.

- Rent paid

- Mortgage interest

- Council & water rates

- Insurance

However, the area that is claimed under this method means that the Capital Gains tax Principal Residence is lost on the claimed area for the years claimed.

Please call us if you wish to discuss your claim in greater details.

Can you benefit from catch-up super contributions?

It’s that time of year when people are looking for tax deductions. The relatively new catch-up concessional contribution system may be ideal for some.

Long gone are the days when contributions of more than $100,000 could be made into super.

And now that the deducible contribution limit is just $27,500 it just doesn’t leave much to fund for retirement after taking out 15% contribution tax and life insurance premiums. And this low limit becomes more of problem if one doesn’t use their limit in any year(s).

This low limit particularly hurts those who leave the workforce to bring up children. The same can also be said for those who have a couple of tough years financially. This is particularly true of many Victorian business owners during covid and beyond.

The catch up concessional system allows some to contribute more than the $27,500 limit for which a tax deduction can be claimed for the full amount.

To qualify to make a catch-up concessional contribution before 30th June 2024 one must:-

- Have less than $500,000 in super as at 30th June 2023.

- Not used all of one’s limit in any year from 2018/19 to 2022/23.

- Must qualify to be able to make a contribution.

This year is particularly important as it is the first year an unused year will drop off. That is, if you didn’t have concessional contributions of $25,000 accepted by your super fund(s) in the 2018/19 year, that shortfall will be lost if not used by the end of this month.

Things to be wary or mindful of:-

- Some super funds cease accepting contributions by Monday 24th

- The 30th June falls on a Sunday. Those with their own self managed super fund need to avoid making a contribution (banking transfer) after cut off time on Friday 28th June as it will be treated as a contribution in July. That is next financial year.

- And that problem becomes doubly worse if you are not able to make a contribution in July 2024.

- A contribution may not suit you from a tax perspective this year as your income may be too low.

- Or perhaps it is a good year to trigger a capital gain.

- Those with incomes over $250,000 need to be mindful of the extra 15% tax on contributions (and be mindful of how Section 293 income is defined).

- A catch-up concessional contribution cannot be accessed one satisfies what is called a “condition of release” is satisfied (with the main one becoming retired).

So there are many factors to take into consideration.

Whether you should or shouldn’t make a catch up concessional contribution is best done by receiving personal financial planning advice. Such personal advice will address your current situation and future goals and needs. Please let us know if you would like a referral.

2024 super co-contribution

Under the super co-contribution scheme, the government will contribute $1 for every $2 of personal contributions made by an employed or self employed person.

The maximum government co-contribution is $500. So if you wish to target the full $500, you will need to contribute $1,000.

To be qualify, one must:-

- Be employed with their employer paying the compulsory SGC or be a self employed person running a business.

- Have 10% or more of one’s income coming from employment and/or a sole trader business.

- Be less than 71 at the end of the financial year.

- Have combined assessable income (that being income before deductions), Reportable Fringe Benefits (RFBA) and employer super contributions in excess of basic SGC amount (RESC) of less than $60,400.

- Have paid a non-deductible contribution into superannuation from after tax money by 30thJune 2024. This means the contribution must be made from a personal or joint bank account.

- Not be a temporary visa holder.

- Lodge a Tax Return for the year ending 30thJune 2024.

- The maximum co-contribution for a personal contribution of $1,000 is $500 if your combined assessable income is under $45,400. Thereafter it progressively reduces by 3.333 cents for every dollar in excess of $45,400. There is no entitlement if your combined assessable income exceeds $60,400.

- Not have contributed more than your non-concessional cap.

- Have a total super balance under the Transfer Balance Cap (between $1,800,000 and $1,900,000).

If you want to find out what you might be entitled to, click on the following link to the ATO’s calculator here

Other matters to note are:-

- One’s own contribution and that made by the government will be preserved. That is, one will not be able to access it until one retires or satisfies another condition of release.

- The ATO will deposit the co-contribution into one’s super account once they have reconciled one’s lodged 2024 Tax Return with the information provided by one’s super fund(s). Consequently, most co-contributions will not be credited until at least January 2025.

- If your super is with a public or employer superannuation fund, you will need to ensure they accept such contributions. You also need to obtain the appropriate form.

- You will need to make your contribution well before 28th June (as 30th June falls on a Sunday). For those with your own SMSF, your fund can only accept such a contribution if permitted by its trust deed. We will take no responsibility where a client does not consult with us beforehand.

What is best for you depends on your circumstances and take into account a large number of considerations.

You should therefore seek financial planning advice to ensure such a contribution will work as intended and is in your best overall interests.

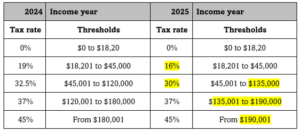

Tips and traps in the 2024 Federal Budget

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March super payment reminder

Friday 26th April is the end date for satisfying Super Guarantee (SG) super obligations for the March 2024 quarter.

But as super clearing houses may take up to 8 days to pass the money through to the super fund, it means that processing and payment to the clearing house should be made no later than Tuesday 16th April.

Please note the ATO’s Small Business Clearing House has a much shorter clearance period – read more at https://www.ato.gov.au/businesses-and-organisations/super-for-employers/paying-super-contributions/how-to-pay-super/small-business-superannuation-clearing-house/clearing-house-terms-and-conditions

And please make sure you have been calculating SG super at 11% since it increased on 1st July 2023.

We take the opportunity to remind you that SG super is payable on all forms of remuneration including:-

- Commissions.

- Bonuses (but see below).

- Directors’ fees and all other forms of remuneration to directors.

- Allowances (except where fully expended).

- Individual contractor paid mainly for their labour.

But excluding the following forms of remuneration:-

- Overtime.

- Reimbursements.

- Unused annual leave on termination.

- Bonuses that are only in respect of overtime.

- Bonuses that are ex-gratia but have nothing to do with hours worked (harder to satisfy than what you might think).

- In respect of employees younger than 18.

- Employees carrying our duties of a private or domestic nature for less than 30 hours in a week (such as nannies).

- On quarterly remuneration greater than $62,270.

- Non-residents performing work for an Australian business outside Australia.

SGC super should never be paid late as late payments attract substantial interest and penalties. Furthermore, and SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

We welcome any question you might have.

SG deadline reminder for Dec 23 qtr

I trust you had an enjoyable festive season – but it is now time to focus on time critical obligations. So here is a quick SG deadline reminder.

With the 28th falling on the weekend and the Australia Day public holiday on the 26th, Thursday 27th January is the end date for satisfying your Super Guarantee (SG) super obligations for the December 2023 quarter.

Please make sure you do not confuse this obligation with the December quarter BAS. The December quarter BAS automatically has a one month extension to 28th February . There are no extensions for reporting and payment of SG super.

Please note that super clearing houses can take up to 8 days to pass the money through to the super fund. It therefore means that processing and payment to the clearing should be made as soon as possible.

And please make sure you have been calculating super at 11%% since it increased on 1st July 2023.

Please refer to our previous quarterly reminder as to what forms of remuneration are subject to and not subject to Superannuation Guarantee.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically can become personal debts of directors.

We welcome any questions you might have.

Christmas & tax (& FBT & GST)

Entertaining and providing gifts at Christmas time to staff, customers and suppliers is a cost of doing business. However, there are some important FBT, GST and income tax considerations and outcomes to keep in mind.

As an employer, you need to be careful at what you provide at Christmas. The rules are complex and the costs of getting it wrong can prove very expensive.

We will outline some of the more common scenarios and what to be careful of.

Under-pinning the implications are the following key points:-

- Christmas parties, entertainment and gifts are all treated under entertainment tax rules.

- FBT applies to benefits given to employees.

- There are no FBT implications on entertainment and gifts given to customers, clients and suppliers.

- A business can adopt one of three methods to quantify the taxable components of any entertainment expenditure – in fact there are 38 permutations depending on who is entertained where, how and with whom. We will largely address the actual method which is the one used by most small businesses (as it usually results in the best outcome). It is beyond the scope of this briefing to address the 12 week log method and we will only touch upon the 50/50 method where relevant.

- Christmas comes but once a year and to the best of my knowledge and experience does so on 25th Nevertheless, the ATO treats Christmas parties and gifts as being what are called minor, infrequent and irregular benefits.

- Such minor benefits are FBT exempt where they cost less than $300 (including GST) provided the actual method is used to quantify entertainment.

The Christmas party

Where entertainment is calculated under the actual expenditure method (which is the most common method for small businesses):-

- A Christmas party is held on-site on a work day, the whole cost for each employee will be an exempt fringe benefit. So too will the spouse’s cost provided the cost per spouse is less than $300. No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend. Taxi travel to or from the workplace (not both ways) will be exempt from FBT and not tax deductible.

- When a Christmas party is held off the work premises, then the whole cost will be exempt from FBT provided the party costs less than $300 per person (employees and their spouses). No income tax deduction can be claimed for the cost of the party including that in respect of any family members that may attend.

- If an external Christmas party costs more than $300 or more per person then the total cost is subject to FBT.

- The cost of any entertainment provided during the party (whether that be at the work premises or outside) will be exempt if it costs less than $300 per head – for example a DJ, musician, clown and comedian.

- The cost of entertaining clients, customers and suppliers is not subject to FBT and is not tax deductible.

- Where any exemption is exceeded then FBT is payable. Consequently, an FBT Tax Return must be lodged and FBT paid (the FBT tax rate being the same as the top marginal tax rate). Please keep this in mind when completing the 2018/19 FBT Questionnaire in early April 2019.

- All other entertainment during the year will be subject to FBT on a case by case basis.

Where entertainment is calculated under the 50/50 method:-

- 50% of the cost will be subject to FBT and this portion will be tax deductible. The other 50% will not be subject to FBT and will not be tax deductible. An FBT Tax Return must be lodged and FBT paid.

- Only taxi travel from home to the venue will be FBT exempt and not deductible for tax.

- 50% of all other entertainment during the year will be subject to FBT.

Gifts

The following gifts are exempt from FBT and are tax deductible:-

- Hampers, bottles of wine, gift vouchers, a pen set costing less than $300 (inclusive of GST).

The following gifts are subject to FBT and are not tax deductible:-

- Tickets to a sporting event or theatre, holiday, accommodation, etc.

The GST treatment of gifts is:-

- That the GST component of any tax deductible portion can be claimed back.

- But the GST component that relates to the non tax deductible portion can’t be claimed.

Please do not hesitate to call us should you have any queries.

Small businesses protection against unfair contract laws

Unfair contract laws to protect small businesses were introduced in 2016. We are pleased to report that as of Thursday 9th November, they have substantially tightened.

One of the main changes is that fines can now be imposed against those enforcing unfair contract terms on small businesses. Those fines are up to $2,500,000 for individuals and $50,000,000 for corporations. Previously there were no fines. Now these laws have some teeth!

Furthermore, a person who breaches the new rules can be disqualified from being a director for up to 6 years.

Following are some examples of unfair contract laws (where it gives one party but not the other):-

- Vary the terms of a contract.

- Terminate a contract.

- Renew or not renew a contract.

- Apply penalties to the other party for a breach of contract.

- Vary the price payable without the other party having the right to terminate the contract.

- Vary the characteristics of the contracted goods or services.

- Restrict one party’s right to the sue the other party.

- Another important change is the definition of a small business has been increased from 20 to 100 full and part time employees.

The somewhat recent small business protection now really has some teeth. Moreover, it will act as a deterrent against those who have unfairly acted against small businesses in the past.

Please contact us if you would like a referral for a unfair contract matter to a qualified lawyer.