Posts Categorized: Tips of the week

Urgent ASIC DIN requirement

This is an urgent reminder to those directors who have yet to apply for their ASIC Directors Identification Number (DIN).

You now only have 3 weeks left in which to apply and receive your DIN.

Not obtaining one by the due date is a criminal offence and subject to a fine of $13,320.

It is also a civil offence which attracts a fine of $1,100,000.

We have progressively been publicising this obligation in our newsletters and remind you of our blogs which you can read at:-

19th October 2021 – click here re what is a DIN and your obligations.

8th February 2022 – click here for update on DIN requirements.

3rd April 2022 – click here for DIN obligations for first time directors.

At this stage it now appears too late to request a paper form and have it processed in time.

Online is the best way of applying. You can do so by clicking here.

However, if you have differences in your name as registered with different government authorities, it is best to ring 13 62 50 (and do so in the morning).

Please call us if you have any question – but above all else don’t leave this any longer – apply today!

$2,000 grant to help you take control

A new state government grants recognises that whilst many small businesses have survived covid lockdowns they still have lingering needs and require further assistance to ensure:-

- Profitability

- Sufficient cash flow

- Have greater insight over their business

- Better plan for the future (and do so in light of new business norms and changing customer behaviour).

To enable and encourage this, a Specialist Advice Pathways Program grant of $2,000 will be paid to enable the receipt of qualified professional support.

So what are the qualifying criteria to receive the grant?

- Be a company, trust (with a corporate trustee), partnership or individual.

- Have held an ABN at 1st July 2020.

- Being registered as an employer with Worksafe Victoria – that is have a WorkCover policy.

- Have between 1 and 19 full time equivalent employees (presumably at the time of application).

Sole traders and partnerships that don’t employ anyone are not eligible nor are trusts where an individual or individuals are trustees.

Isn’t this great – your business might qualify to receive $2,000 of funding for one or more of these fundamentally key activities:-

- Advice and analysis regarding the management of cash flow, preparation or cash flow budgets and projections

- Profitability analysis and formulation of financial management and/or operational business strategies

- Strategic analysis to revise business planning and/or governance arrangements

- Advice regarding the management of debts and liabilities

- Advice and/or representation regarding commercial agreement contract terms (i.e. commercial leases or commercial supply contracts).

So who can provide these services?

We can (except the last which is legal)! A service provider needs to be a registered:-

- Accountant / tax agent

- Book-keeper

- Lawyer

As such, business coaches are excluded.

So how do you apply for the grant?

Unlike past government grants, we, as the qualified service provider, can’t apply on your behalf.

One must apply by 30th September – but like with past grants, applications will close earlier if the allocated funds are exhausted before then.

Applications will be assessed with a confirming approval email to be sent by the end of October.

It is important that we be involved with this process as:-

- It requires the ABN Registry to be correct for which we will need to check and possibly update (noting that with the ABN system being introduced in 2000, the registry appeared somewhere in the late 2000’s and many not have been updated)

- As the Qualified Service Provider, we need to prepare a service agreement. That agreement either needs to be attached to the application or its key contents set out in the application.

You will need to upload at least one identifying document. You will also need to include my professional membership details.

Other matters of note

- The services must be delivered by the end of January 2023.

- You will need to complete a statutory declaration as to the services provided.

- Payment is made in 2 lots – $1,000 within 20 days of acknowledging the successful application email and within 20 days of completing the final claim form.

- You will also be requested to complete a short survey.

- You will also be required to attest that all industrial relations obligations are being met – which include having evidence of having supplied all employers with the 11 national employment standards.

So what will be the cost of the services I require?

Well that will depend on:-

- How many of the first 4 stated services you require and

- The complexity of your business and

- The quality of your financial information.

We are building a matrix to determine the investment into attending to any of the qualifying services and provide you with the required service agreement.

Where do I register?

https://businessvic.secure.force.com/GrantsPortalLogin

Next steps

Alex Stewart is contacting existing clients to discuss their situation and how they will benefit from this grant. Unlike past state grants, Sam Della Bosca can’t apply on your behalf but she will guide applicants through the process.

By way of closing comment, please don’t let this opportunity slip by. Every small business should undertake these qualifying activities. And now that the troubling days of 2020 and 2021 are behind us, this gives you the chance to undertake proper planning for the future.

Are you complying with your new landlord obligations?

Are you complying with your new landlord obligations?

There has been a lot of covid noise over the last 2 years so perhaps you might have missed this new obligation.

A landlord musty ensure a residential property meets basic minimum standards for leases entered into from 29th March 2021. It also applies to fixed term agreements that rolled over into periodical agreements after that date (that is leases that become monthly upon the end of the lease term).

There are 13 minimum standards (with a 14th of electrical safety from 2023):-

- Door locks

- Bins

- Toilets

- Bathrooms

- Kitchens

- Laundry

- Structural soundness

- Mould and dampness

- Window coverings

- Windows

- Lighting

- Ventilation

- Heating

It is your obligation as a landlord to ensure that these standards are met.

It has come to our attention that some agents are trying to circumvent this by just having the landlord sign something.

I would hate to think where such landlords would sit if something went wrong.

A proper way to attend you is to have your property inspected by a building inspector that way you fulfill your needs. You also have the added benefit of knowing your investment is in good condition or need of repair before it becomes more costly. How would you know or even know to identify if there was early termite infestation under the sub floor?

We have had dealings with a number of building inspectors across Melbourne and would be happy to give you an introduction.

You can also read more about landlord obligations at www.consumer.vic.gov.au/housing/renting

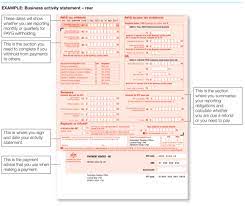

Are your PAYG or GST Instalments too high?

Quarterly BAS’s for the June 2022 quarter that contain GST or PAYG Instalments are due for lodgement this Thursday.

If your instalments for the year including June’s is close to the year’s actual liability then no action is required.

If either instalment is less then you will be asked to pay the shortfall by the time the 2022 Tax Return is lodged. You can though increase your June quarter instalment if you wish to not be sitting on the cash until May next year. This may also suit you if you are worried about not having the required funds when the shortfall(s) falls due.

But what if either instalment for June will take you well over what you are required to pay for the year?

If you do pay it, then it is not the end of the world as any excess amount will be refunded to you when the 2022 Tax Return is lodged. But why drain your funds in the meantime?

You are entitled to amend the instalment as issued by the ATO. But don’t get too carried away as the ATO does have the power to fine for gross under-estimates.

Do you think your instalments are too high? This is just one of the 67 items we address when undertaking pre year end reviews. So, if you are a client of ours then take comfort that we have already addressed this. If you are not a client, then we welcome a discussion.

I take the opportunity to state that the ATO has resumed normal operations. Since covid broke, they have not been chasing debts and lodgements. That has all changed as evidenced by the volume of letters and demands issued by the ATO since June. We have even heard of the ATO issuing Director Penalty Notices (DPN’s) to directors. DPN’s can be issued where a BAS obligation remains unreported and unpaid for more then 3 months. The scary part is that once issued, basically speaking, the only way to clear your now personal tax debt is to pay the tax due. Please don’t hesitate to call us if you are concerned about any request by the ATO.

2022 tax planning tips

With 30th June fast approaching, here is a list of common tax planning strategies that we have been discussing with clients:-

- Prepaid revenue can be deferred to the extent that it relates to next financial year and where a customer has the contractual right to cancel the contract at any time.

- Buying items such as stationery, printer cartridges, stamps, etc by Thursday 30th Those of you who entered the Simplified Tax System (STS) by 30th June 2005 (who are therefore automatically assessed on a cash basis) may wish to pay any bills not due until July like your phone bill, rent, printing and stationery, etc. Paying your accounting fees is also recommended!

- STS taxpayers are now known as Small Business Taxpayers (SBTs). SBTs now include taxpayers with an annual turnover under $50,000,000.

- As we have previously highlighted, SBTs can claim a full deduction of any assets acquired. But they must be in your possession ready to use. And if this means installation, then it must be installed before July.

- For more on the instant asset write-off, refer to recent blogs titled Parts 1, 2 and 3.

- SBT taxpayers can also claim a full deduction for payments such as insurances, rent and the like which cost more than $1,000 even though the service period runs past 30thJune and into the next financial year.

- For those of you who receive this e-mail that are employees or rental property owners, you can claim a complete write off for assets costing less than $300.

- If a property is jointly owned, then you can claim the full cost of assets costing less than $600 (meaning you claim less than the $300 limit each).

- Investors can claim prepayments in full. An investor with a property or share loan can claim a deduction for 12 months prepaid interest. Please note that the ATO requires that for the prepayment to be claimed, one must benefit through a lower interest rate (for which you need to keep proof).

- For those who have already generated a large capital gain, consideration should be given to selling other investments that have an unrealised capital loss. Those with no or minimal employer SGC support could consider making a deductible contribution into superannuation to offset the tax on the capital gain (but speak to a financial planner first).

- If you are about to sell an asset which will generate a capital gain, consideration should be given to selling it after 30th This will defer the payment of any capital gains tax liability until as late as early June 2024.

- Companies can accrue a director’s fee which is not payable until the following financial year. Why? – the company gets a deduction in this financial year but the director is not assessed on the income until the following financial year in which it is received. The trick is to document it correctly.

- If you have stock, count it (a separate e-mail will be sent to business clients with stock). As stock can legally be valued differently from item to item and from year to year, it can result in some advantageous outcomes.

- Donations are deductible. It must be a genuine donation so you can’t receive anything in return. Raffle tickets can’t be claimed.

- Our tax planning checklist also considers other items such as writing off bad debts, making Division 7A loan repayments, whether a company can reclaim past tax payments under the loss carry back rules, distributing to a new beneficiary and varying PAYG Instalments. How these and other opportunities are employed depends on your circumstances. We identify what you can do by running through our 67 point checklist.

All of the above tax planning tips are explained to our clients in any easy to read Tax Planning Report. And to give you more control over your cash flow, that report also sets out your income tax payments for the next 12 months.

We welcome any query about these tax planning tips.

We end this blog by taking the opportunity to remind you of:-

- The need for those who were directors before November 2021 to apply for their Directors Identification Number by early October at the absolute latest.

- Single Touch Payroll reporting fields will greatly expand under what is called STP2 and there is much preparatory work to be undertaken. And with STP2 now to be shared with Fair Work Australia, you don’t want to be getting it wrong! We encourage you to adopt the new system as soon as possible as any extension only causes more work later. Please let us know if you would like a referral to a payroll expert.

What are the new super limits?

So what are the new super limits that apply to this financial year and then from July 2022?

Please click here to access super limits about:-

- How much money can be put into super.

- How it is taxed whilst in the fund.

- Tax and limits on money being paid out of super.

Under the Corporations Law, the following are all personal advice:-

- Advising on whether you should make any form of contribution.

- Start or stop a pension.

- Whether to withdraw money as a pension or lump sum.

- Accountants are unable to provide such personal advice – that is unless they are otherwise licensed as a financial planner.

And it is with good reason this is so. Too often people decide upon a course of action for which they are unaware is not in their best interests, whether that be in the short or long term.

Furthermore, those with own self managed super fund can embark on a course of action which leads to either a fineable breach or restrict the amount of money that could otherwise be concessionally taxed.

Top 11 tax planning tips for 2022

So here we are in the middle of June with business owners understandably looking to save tax.

There are a raft of legal ways to either permanently save tax or obtain timing advantage. And in tough and volatile times like this, what could more be important than not letting your cash reserves unnecessarily leak.

In light of recent tax changes there are some new considerations. And for others, common strategies take on greater importance.

On Thursday 18th June we will explain the top 11 tax planning tips for 2022. You can book your place by clicking here.

And our webinar will also feature Bobby McKeown who will take you through all the important must do actions that all employers must implement before July.

With so much to learn and for you to act upon we look forward to seeing you on Thursday. All you need to do is to invest 25 minutes of your time from 5:30pm.

How does the super co-contribution work?

Under the super co-contribution scheme, the government will contribute $1 for every $2 of personal contributions made by an employed or self employed person. The maximum government co-contribution is $500. So if you wish to target the full $500, you will need to contribute $1,000.

To be qualify, one must:-

- Be employed with their employer paying the compulsory SGC or be a self employed person running a business.

- Have 10% or more of one’s income coming from employment and/or a sole trader business.

- Be less than 71 at the end of the financial year.

- Have combined assessable income (that being income before deductions), Reportable Fringe Benefits (RFBA) and employer super contributions in excess of basic SGC amount (RESC) of less than $56,112.

- Have paid a non-deductible contribution into superannuation from after tax money by 30thJune 2022. This means the contribution must be made from a personal or joint bank account.

- Not be a temporary visa holder.

- Lodge a Tax Return for the year ending 30thJune 2022.

- The maximum co-contribution for a personal contribution of $1,000 is $500 if your combined assessable income is under $41,112. Thereafter it progressively reduces by 3.333 cents for every dollar in excess of $41,112. There is no entitlement if your combined assessable income exceeds $56,112.

- Not have contributed more than your non-concessional cap.

- Have a total super balance under the Transfer Balance Cap (between $1,600,000 and $1,700,000).

If you want to find out what you might be entitled to, click on the following link to the ATO’s calculator here

Other matters to note are:-

- One’s own contribution and that made by the government will be preserved. That is, one will not be able to access it until one retires or satisfies another condition of release.

- The ATO will deposit the co-contribution into one’s super account once they have reconciled one’s lodged 2022 Tax Return with the information provided by one’s super fund(s). Consequently, most co-contributions will not be credited until at least January 2023.

- If your super is with a public or employer superannuation fund, you will need to ensure they accept such contributions. You also need to obtain the appropriate form.

- You will need to make your contribution well before 30th June. For those with your own SMSF, your fund can only accept such a contribution if permitted by its trust deed. We will take no responsibility where a client does not consult with us beforehand.

What is best for you depends on your circumstances and take into account a large number of considerations.

You should therefore seek financial planning advice to ensure such a contribution will work as intended and is in your best overall interests.

How to maximise your position through PROPER tax planning

Proper tax planning done well is pivotal to maximising your position.

Our process takes into account:-

- Opportunities to be taken up

- Issues that need to be rectified

- Attend to a variety of must do compliance tasks

- Recommendations to improve your tax position (both in current and future years).

- And also takes into account various government benefits such Family Tax Benefit and Senior Health Concession Card.

Our 5 page checklist ensures you don’t miss out on the good stuff you are entitled to. We also ensure you avoid the bad stuff.

Our 5 page checklist is our internal process. What our clients are issued with though is report which clearly sets out what:-

- Our recommendations are.

- You need to implement (both before and after 30th June).

- The financial benefit will be to you.

- Your tax payments for the next year.

- All in plain English and easy to read (and re-read). It’s not some short email or quick conversation. It is all set out in an easy to read report.

Are you concerned that your accountant doesn’t have the same robust process to ensure you are better off? We welcome the opportunity to discuss your situation with you.

And you may also wish to join me on Thursday morning as I deliver a presentation on proper tax planning. It’s a Zoom meeting that concludes at 8.30am so it won’t break into your working day. Please email me if you would like the details so I can register you.

The latest on the ATO’s attack on trusts

May I start by reporting that there has been a welcome shift by the ATO away from its controversial quantum shift in how they would regard trust distributions.

There are a great number of unfortunate ramifications that could flow from the ATO’s attack on trusts – in particular extra taxes, interest and penalties. Got your attention?

But amongst all the possible outcomes, there is one key matter to factor in going forward. If your trust distributes to an adult child or company, then that amount must be paid to them AND they must keep evidence that they used those monies for their benefit.

But let me set the scene before exploring those developments

As you will have read from our client emails on 1st and 21st March, the ATO announced, to put it mildly, a totally unexpected shift in the way they would regard trusts distributions. Moreover, they announced their right to retrospectively adjust taxable income and levy fines and interest as they saw fit. Going retrospectively back all the way to the 2014 financial year!

In doing so, the ATO were disregarding a court case they lost before the Federal Court. They somehow think they are above the law and can ignore court decisions. And even though they are now appealing that decision to the High Court, they have not fully withdrawn.

They still hang their hat on a 2014 fact sheet. Fact sheets are not law. They are not legislation. They are not binding on taxpayers and tax agents. But the ATO are defending themselves on this as a legislative line in the sand – and doing so even though they have done nothing about it in the following 7+ years.

So what as the initial reaction?

It has caused a storm of anger amongst accountants and lawyers. And accounting bodies and professional firms have been lodging submissions in numbers not seen before.

It even resulted in the Federal Treasurer Josh Frydenburg visiting my accounting discussion group the week before last.

Even though it does happen, I can’t tell you of a single instance where a professional body or firm has lodged a submission to a public tax ruling. It happens but one never hears about it.

This is different.

There was such a howl that the initial submission date of 8th April was extended to 29th April. And it came last week that it had been extended again. Certainly Frydenburg made no comment as to extension on 27th April. No-one seems to have heard about a further extension until late last week when the IPA announced they had lodged a submission (perhaps they were late and accommodated out of courtesy?).

Where are we at now?

Whilst this new approach hasn’t been dropped (noting that the High Court has yet to hand down its position) the ATO have a least back pedalled.

Three comments of note made by the ATO Deputy Commissioner Louise Clark are that:-

The ATO is not concerned when profits from the family business are distributed to members of the family who work in the management of the business and then that family member chooses to reinvest the profits in the business.

The ATO will not be pursuing taxpayers who entered into arrangements between 1 July 2014 and 30 June 2022 where, in good faith, they concluded that section 100A did not apply to them based on the previous 2014 guidance.

“I want to reassure the community – we won’t have a retrospective element. We stand by our 2014 guidance for this interim period,”

They are only words. There are still inconsistencies in the ATO’s position. The law has remains the same and has not been changed. They are still taking a very aggressive position not supported by law and 43 years of practice. But at least we have some movement towards normality.

So what happens next?

We await the High Court’s decision.

It is not unreasonable to expect nothing changes before they decision is handed own. But the reality will probably be that the ATO will finalise their ruling as they see fit.

Please be assured that professional accounting bodies will continue to seek what is fair and reasonable.

In the meantime, we at least have the comfort that prior years and indeed 2022 will not be under the microscope as first announced.

But from July 2022, it will be a different world if the ATO only gets part of what they decreed back in February.

This is far from settled but we do welcome your questions.