Posts Categorized: Tips of the week

A quick lockdown update

So back into lockdown we go!

We are most sympathetic to those businesses that will suffer financially from this latest lockdown, particularly those in entertainment and hospitality.

The Maggs Reid team is now all back at home but thankfully due to modern technology, will be able to operate almost normally. We do ask that you contact us by e-mail during this time.

Financial assistance

The state government is yet to announce any financial assistance to small businesses. Please be assured that we will update you as soon as details are announced – but judging by one minister’s comments this morning, that, for unknown reasons that surprise me, won’t be until next week.

Compulsory QR codes

As a generalisation, businesses that deal with the public are now required to track visitors to their business electronically by using the government’s free QR service. Such businesses could use other QR services from 30th April, but as of today, must use the government QR service. You can read more at – https://www.coronavirus.vic.gov.au/about-victorian-government-qr-code-service. Although we are not one stated industries that must use a QR system, we have adopted one as of yesterday as we believe it is a better system than manual sheets.

Survive and Thrive webinar

I take this opportunity to remind you that the next Survive and Thrive webinar will be held on Wednesday 9th June at 5:30 PM. This month, we will address tax planning actions required before the end of the year. And I’m sure all business owners will be interested in our guest speakers presentation on three legal common traps for small business owners. You can book your place at – https://us02web.zoom.us/webinar/register/WN_l5ZhIapvTTqDqoKSSKStxg

Tax lodgements

Like all accountants, the demands of JobKeeper, rent relief applications, Land Tax applications, JobMaker, cash flow preparations to support loan applications and so on have meant that we are still to finalise and lodge a number of 2020 Tax Returns. In fact that my accounting discussion group meeting on Wednesday night, no accountant, not one, managed to meet the required 85% lodgement deadline of last week. Please do not be concerned as the ATO are tolerant and are rubber stamping all extension requests. In managing our lodgement listing, we are cognisant of people’s positions and are prioritising those matters that require early retention. We do appreciate your ongoing patience in he most unusual period.

Portal improvement

I should again state that we have been preparing 2020 Tax Returns using new software; software that talks to other programs. As part of this process we have been able to adopt better client portal and digital signing software. What this also means is that the existing portal will be inaccessible after 30th June. We assure you that we of course have copies of everything we have dropped into your portal. We have also saved copies of any documents that you have dropped into your portal. You may though wish to retrieve any document you want at your electronic finger tips.

Stay safe and we look forward to seeing you soon.

What’s in the Budget for you?

What’s in the Budget for you?

Probably significantly more than you think.

As what is now unfortunately the norm, there were plenty of pre-announcements before Budget night. But there is much more to the Budget that was announced on Budget night or leading up to it.

In addition to some key business announcements (extension of loss carry back company rules and instant asset write-off) there were very welcome announcements to being able to getting more money into super. Welcome I say as how can one provide for retirement with a contribution cap – which currently sists at $25,000 before being eroded by 15% tax, life insurance premiums and for some an extra 15% tax).

Also of note were the proposed changes to personal and self managed super fund residency rules. I say welcome as the existing rules are quiet archaic in context of how people today live, work and travel – mind you we still aren’t going anywhere for a while with covid.

We will explore some of the key measures in our next survive and thrive webinar. It will beheld at 5.30pm on Wednesday 2nd June and you can book here – https://tinyurl.com/reg0206

We will also flesh out some opportunities in upcoming blogs.

But having said all that, please keep in mind that:-

-

A Budget is only ever a series of announcements,

-

They still have to be legislated,

-

They may be changed slightly and

-

Many have start dates form July 2021 – and we may have a change of government before then.

Please though don’t hesitate to call us if you any questions.

Is your business required to have a QR code system in place?

Is your business required to have a QR code system in place? With so much going on and such little information distributed by the state government about covid requirements, it is understandable you may not know.

The answer is it depends what your business does.

All prescribed businesses must have a QR code system in place by Friday 30th April. The amnesty period, which has already been extended once, will come to an end this Friday.

A QR code system will not cost you anything other than your time if you use the Victorian Government QR code service.

So is your business one that must have a QR code in place by Friday?

You can check by clicking on the following link here.

And please remember if your business is not required to have a QR system in place, it will still have to record all visitors to your business premises. So may be you are better off moving from the existing paper sign in register to a QR code system.

You can access the paper log by clicking here.

You can access the posters required to be shown in your workplace by clicking here.

Survive & thrive webinar

As we head into a brave new post-JobKeeper world, there is much to keep abreast of.

So our Survive & Thrive webinars are back!

About the Webinar

In our next 25 minute webinar we will

-

Update you on actions required in May (including new rules for those who employ casuals).

-

With a hot property market, our guest speaker Martin Ryan will explain recent property loan developments.

-

And our case study will explore the peril of selling to customers who may not be able to pay you. This has never been so important now that so many business don’t have the JobKeeper financial safety net.

We will also feature special client offerings – and one will of great interest to many.

The webinar will run from 5.30pm, so grab a cup of tea (or beer) and tune in.

And if you away from your home or office, you can still watch it on your phone.

You can register by clicking here

We do hope you can join us on Wednesday, 5th May at 5.30 pm

Entertainment can be taxing

Entertainment can be taxing. That’s an understatement as there are 3 aspects – tax deductibility, GST and Fringe Benefits Tax (FBT). There are 38 outcomes depending on who does with whom where and why. It therefore requires careful analysis

No wonder the ATO has such a great strike right in FBT audits on entertainment.

But that’s not all that has to be considered. For FBT purposes, an employer has to determine which of three methods produces the best result. Although that said, the actual method for quantifying the FBT taxable value of entertainment is usually best for small employers (but not always!).

You can read more on the following factsheet – FBT Flyer – Meal Entertainment Factsheet

Confused or concerned? That’s understandable. We would be happy to discuss your situation.

We take this opportunity to state that the prudent action is to lodge an FBT Tax Return – even if nothing is payable (which is usually the case for small businesses). This extra step is not a waste of time nor money as it starts the audit clock ticking – after 3 years the ATO can’t go back and audit you; don’t lodge an FBT Tax Return and the ATO can go back as far as they like.

Urgent SG super reminder

Wednesday 28th April is the end date for satisfying Super Guarantee (SG) super obligations for the March 2021 quarter.

But beware as some of the clearing houses have a submission and payment deadline well before then. May be even today!

SG super is payable on all forms of remuneration including:-

-

Commissions

-

Bonuses (but see below)

-

Directors’ fees and all other forms of remuneration to directors

-

Allowances (except where fully expended)

-

Contractors paid mainly for their labour

But excluding the following remuneration:-

-

Overtime

-

Reimbursements

-

Unused annual leave on termination

-

Remuneration of less than $450 in a month

-

Bonuses that are only in respect of overtime

-

Bonuses that are ex-gratia but have nothing to do with hours worked; which is harder to satisfy than what you might think

-

In respect of employees younger than 18

-

Employees carrying our duties of a private or domestic nature for less than 30 hours in a week (such as nannies)

-

On quarterly remuneration greater than $57,090

-

Non-residents performing work for an Australian business outside Australia

If your payroll system has been set up correctly then it will perform these calculations for you. We would welcome the opportunity to assist you with this and if need be refer you to a good book-keeper.

SG super should never be paid late as late payments attract substantial interest and penalties. Furthermore, and SG (and BAS) liabilities that remain unreported and unpaid after 3 months automatically become personal debts of directors.

The SG rate remains at 9.50%.

So if you haven’t paid your employer super obligations already, we recommend doing so today!

Do I have to pay FBT on my workhorse vehicle?

Do I have to pay FBT on my workhorse vehicle (think utes, vans and taxis)?

Well it depends.

There has and still is an exemption for private use that is minor, infrequent and irregular.

The problem is the ATO recently announced safe harbour provisions. And those safe harbour provisions are probably more restrictive than what most people think.

These provisions also dictate record keeping that wasn’t required previously.

Want to know more – then click on the following link.

FBT Flyer – Workhorse Vehicles and new safe harbour provisions

Why is this important?

Well if any private use doesn’t satisfy the safe harbour tests to minor, infrequent and irregular travel then the business is subject to Fringe Benefits Tax.

And this leads to the next point of how important it is to lodge an FBT Return (even if no FBT is payable). Lodging and FBT Return starts the audit clock ticking. When three years have passed, the ATO can’t go back and audit that year. Don’t lodge a FBT Return and they can go back as far as they like.

Not sure about your exposure? Don’t want to risk not complying and paying FBT (and penalties and interest)? Then call us.

How are your customers affected by JobKeeper?

There has been much press about the ending of JobKeeper and what it means. The press has largely focused on the most exposed industries such as cafes and restaurants, particularly those in the CBD.

So the question is how exposed is your business if your customers are at risk?

At worst, it may be best to not sell to someone who is at risk of falling over.

So, if

-

it costs you $600 to service a $1,000 sale and

-

they go down owing you $2,000

Then you will need sell someone else another $5,000 just to cover that loss. It’s a tough assignment at any time let alone in today’s market for many business owners.

The sad reality is that most accountants don’t ensure their clients accurately record and report on the trust cost of servicing the sale of a good or service. It’s really really important to know this so for so many reasons – but in context to the discussion here, knowing what is at stake when making a sale that may not be collectable.

So think about whether you should continue to sell to existing customers. Another option is to ask for payment up front.

And now would be a good time to review your terms of trade. And with that, you should consider whether it is worth protecting your interest under the Personal Property Securities Act (PPSA) – the modern form of Romalpa clauses. It’s a measure of last resort but can save your bacon. It’s beyond the scope of a blog to explain how you can use PPSA but we would be happy to explain it to you and refer you to a qualified solicitor to attend to the necessary paperwork.

So in these difficult and unusual times:-

-

Don’t sell to anyone without evaluating their ability to pay.

-

Put the proper protection mechanisms in place.

-

Be crystal clear on what it costs you to sell your goods and/or services.

Want to better understand your situation? Then ask us as we have decades upon decades of experiences gained from a range of clients operating in an array of industries.

Why is the ATO suddenly asking you for money?

If you want someone to pay you then it is a good idea to send them a bill so they can. Seems like common sense – but not to the ATO.

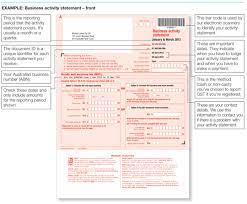

A number of clients have been surprised, offended and/or doubtful of recent payment requests from the ATO. This happened as the ATO elected to cease sending paper activity statements. It seems as though many did not receive a reminder through their MyGov account – or if they did, ignored it legitimately thinking it was a scam.

So will you get into trouble?

The answer is no.

We understand that the ATO will revert to issuing paper statements.

We do though recommend periodically checking your MyGov account just in case you have missed something. Once you have opened a My Gov account, they will no longer issue you with a physical assessment notice; even we aren’t issued with one. They also cease issuing super S293 notices and the like.

But never click on a link within a MyGov email as it may well be a hoax. Log in separately from your internet browser.

Why getting your FBT exposure right is so critical

So why getting your FBT exposure right so critical?

Before we answer that question, I will answer the base question of what is a fringe benefit. A fringe benefit is anything provided by an employer to an employee other than by wage/salary and super.

As such it includes such things as:-

-

Passenger cars

- Car parking

-

Entertainment

-

Selling firm’s goods at a discount

-

Providing accommodation

-

Paying any employee bill whether that be school fees, mortgage, health club membership and so on.

And this leads to the understanding of how to address your FBT exposure which can be summarised as:-

-

Determine whether you the employer are exempt (charities, public hospitals) or subject to a reduced rate (private schools).

-

Determine what fringe benefits you have provided to whom

-

Assess whether an exemption or concession applies to that type of benefit. There are some special rules which benefit small businesses.

-

Calculate the taxable value

-

Then, and this what most people get wrong, determine whether the employee is better off making a contribution to reduce the fringe benefit rather than pay FBT tax (which is equivalent to the highest marginal tax rate).

-

Prepare and lodge the FBT Tax Return.

The reality is that all too many employers get this wrong as the ATO is successful in making an adjustment in 50% of FBT audits. That’s every second audit!

And don’t think the ATO doesn’t think this is a big audit target. One recent project was their recording the number plates of all utes parked at an AFL game at the MCG. Those plate numbers registered to companies were then cross matched with lodged FBT and Income Tax Returns. The ATO had a field day.

So what should you do?

Well for our clients we run through a checklist to make sure all benefit s provided are identified. We will then work through (a) quantifying the benefit before (b) determining the most efficient manner of dealing with the benefit and then (c) lodge an FBT Return (we do this even if the taxable value has been reduced to nil as the ATO have therefore issued an assessment and then only have two years to audit.

And with that I return to the question of why is getting your FBT exposure right is so critical? As you will now be able to appreciate there is more than answer to this question:-

-

It is a key ATO audit area.

-

If it is wrong in one year, the ATO will start auditing all years.

-

With the FBT tax rate being the equivalent of the highest marginal tax rate, the tax can be significant.

-

The ATO readily applies both interest and penalties.

-

The audit clock will start clicking once an FBT Tax Return sis lodged – after that the ATO can’ t go back further than 2 years.

Do you have any questions? We would welcome the opportunity to discuss them with you.