Posts Tagged: BAS

February lodgement deadlines

With the Christmas holidays now behind us, we are now back in normal lodgement patterns. So here are the lodgement deadlines for February.

Deadlines for the month of February 2025 are:-

- 7th – monthly Pay-roll Tax – January 2025 remuneration

- 21st – monthly BAS remitters – January 2025 BAS

- 21st – quarterly BAS lodgers with monthly PAYG Withholding remitter – wages tax for January 2025

- 28th – quarterly BAS lodgers – December 2024 BAS

It is timely to remind all taxpayers that the ATO has been on the war path of late.

Whist they were friendly (perhaps overly friendly) during covid, the ATO is now actively chasing unlodged documents and moreover aggressively chasing tax debts.

It is also no longer easy to have late lodgement penalties and interest removed (no matter what the cause reason is).

And it is recounted by many fellow accountants that the ATO continues to issue Director Penalty Notices (DPNs) at an alarming rate. DPNs are issued where GST, PAYG Withholding or SG super remains unreported and unpaid after 3 months. A DPN makes a director(s) responsible for that debt. Options are limited and require prompt action – and if not paid or otherwise dealt within 30 days, a director will be left being personally responsible for that debt. This could mean bankruptcy.

You can read more about unpaid super here

I have also heard of where a director’s address as recorded with ASIC is out of date. The problem then is the ATO will mail the DPN notice to the address as recorded with ASIC. So apparently some directors have been unaware one was even issued.

There is also an issue that the 30 day countdown starts from the time the ATO issues a letter. The problem is that it may take 6 days to be received.

TIP Advise us as soon as you change address. In any case there is a 28 reporting deadline for reporting a change of director’s details to ASIC.

TIP Don’t fall for the mistake of not lodging or paying a BAS or SG super whatever the reason. In the first instance you will avoid late lodgement fines. Secondly, you can always enter a payment plan if necessary.

Are your PAYG or GST Instalments too high?

Quarterly BAS’s for the June 2022 quarter that contain GST or PAYG Instalments are due for lodgement this Thursday.

If your instalments for the year including June’s is close to the year’s actual liability then no action is required.

If either instalment is less then you will be asked to pay the shortfall by the time the 2022 Tax Return is lodged. You can though increase your June quarter instalment if you wish to not be sitting on the cash until May next year. This may also suit you if you are worried about not having the required funds when the shortfall(s) falls due.

But what if either instalment for June will take you well over what you are required to pay for the year?

If you do pay it, then it is not the end of the world as any excess amount will be refunded to you when the 2022 Tax Return is lodged. But why drain your funds in the meantime?

You are entitled to amend the instalment as issued by the ATO. But don’t get too carried away as the ATO does have the power to fine for gross under-estimates.

Do you think your instalments are too high? This is just one of the 67 items we address when undertaking pre year end reviews. So, if you are a client of ours then take comfort that we have already addressed this. If you are not a client, then we welcome a discussion.

I take the opportunity to state that the ATO has resumed normal operations. Since covid broke, they have not been chasing debts and lodgements. That has all changed as evidenced by the volume of letters and demands issued by the ATO since June. We have even heard of the ATO issuing Director Penalty Notices (DPN’s) to directors. DPN’s can be issued where a BAS obligation remains unreported and unpaid for more then 3 months. The scary part is that once issued, basically speaking, the only way to clear your now personal tax debt is to pay the tax due. Please don’t hesitate to call us if you are concerned about any request by the ATO.

Why is the ATO suddenly asking you for money?

If you want someone to pay you then it is a good idea to send them a bill so they can. Seems like common sense – but not to the ATO.

A number of clients have been surprised, offended and/or doubtful of recent payment requests from the ATO. This happened as the ATO elected to cease sending paper activity statements. It seems as though many did not receive a reminder through their MyGov account – or if they did, ignored it legitimately thinking it was a scam.

So will you get into trouble?

The answer is no.

We understand that the ATO will revert to issuing paper statements.

We do though recommend periodically checking your MyGov account just in case you have missed something. Once you have opened a My Gov account, they will no longer issue you with a physical assessment notice; even we aren’t issued with one. They also cease issuing super S293 notices and the like.

But never click on a link within a MyGov email as it may well be a hoax. Log in separately from your internet browser.

JobKeeper – can I claim and how do I claim?

|

Whilst many businesses cannot claim the PAYG withholding (wages tax) Cash Flow Boost, many more businesses will be able to claim JobKeeper. Under this stimuli, the government will pay to each qualifying business a flat $1,500 per employee per fortnight. I say business as the scheme is also open to non-employers such as sole traders, partner of a partnership, a beneficiary of trust and one director of a company. Even the first JobKeeper payment fortnight has already passed, the registration process will start next week. The window for that is effectively open for a very short period of time. Don’t register – no soup for you! On Monday, will run a webinar in which you will learn:-

LEARNING OBJECTIVE – by attending this webinar you will:-

Effectively we are giving all of this to you on a plate as this has all been built, collated, summarised and systematised on the back of hours attending technical webinars and reading the mountainous pile you can see in the photo below. |

Please click on the following link to register for the webinar at 4pm on Monday 20th April:-

https://zoom.us/webinar/register/WN_KgK3mKcUQHunYb2PW7hwjA

Another webinar will be run if there is sufficient overflow. If you can’t attend Monday’s webinar then please action the following matter.

IMPORTANT – you need to register your interest with the ATO IMMEDIATELY if you have not done so already. This interest notification merely advises the ATO that you intend to claim; it is not in itself registration. To register your interest, please refer to our blog at:-

https://www.mrsaccountants.com.au/category/covid-19-strategies/

or

https://www.mrsaccountants.com.au/register-for-1/

We remind you to keep referring to our web page for important daily blogs, tips and strategies.

Lodgments and ATO assistance

It is critical that you keep:-

-

Lodging activity statements.

-

Reporting under Single Touch Payroll

-

Meet your super guarantee obligations

Whilst there are various forms of relief available, you are still required to meet all your ATO compliance obligations.

And whilst there are payment extensions to a certain ATO taxes or some are being waived, there is no extension in regard to employee super. It is also important to note that the two-part penalty of a 200% penalty and non-deductibility of anything paid late remains in place.

Paying employee’s super has always been a business’s number one obligation; now even more so!

The deadline for reporting and paying March quarter superannuation is April 28. As some clearing houses take up to 8 business days to pass on any payment into a super fund, we strongly recommend paying the super by this time next week.

The stimulus packages include such concessions being able to vary the March quarter PAYG instalment to nil (and claim back any instalments paid for the September and December quarters), not paying January to June PAYG withholding and up to a six-month deferral for paying bases, tax shortfalls & FBT liabilities.

We remind you not to lodge your March quarter BAS without speaking with us first.

We take this opportunity to remind you to return to this web page for daily blogs on a variety of short videos and business survival tips (including health and well being).

As we are all in this together, we are determined to help as many business owners as possible. We would therefore appreciate you passing on a link to any article you find of interest to your team, family, friends and business associates.

Tax-free “payments” to employers

The main plank to the first and second government stimulus packages has been the announcement of tax-free payments to employers.

It is been incorrectly reported as a payment to employers.

However, there will not be a payment in all cases.

It will be either:-

-

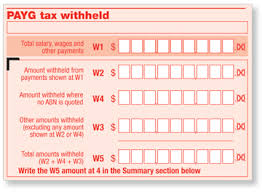

Larger employers will not pay the first $50,000 of PAYG Withholding in respect of the months January to June inclusive (they can also benefit in the first half of 2020/21 but we will cover that in a future blog).

-

Employers who withhold less than $10,000 of PAYG Withholding per year, they will receive a minimum credit of $10,000. If that $10,000 is greater than the other BAS liabilities, then the balance will be paid to the employer.

For those that report PAYG Withholding monthly, they can claim the credit for January and February on the March BAS.

The ATO best describes this as a Cash Flow Boost.

Employers will still be allowed to claim all of the PAYG Withholding as a tax deduction – even though it is not paid.

Employees will still be allowed to claim a tax refund for all of the PAYG Withholding reported – even though the employer has not paid some or all of it.

The ATO has stated that they will pay refunds within 14 days.

Please come back to read updates on how you can benefit from this concession. We also welcome any question you may have.

Upcoming March quarter deadlines

For those of you who are employers, Friday 26th April is the end date for satisfying your SG super obligation for the March quarter. Late payments will attract interest and penalties. As such, this obligation is an employer’s most important commitment so best not to leave it until the last minute; particularly as payments through some super clearing houses take 5 days or more to clear.

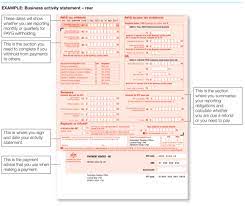

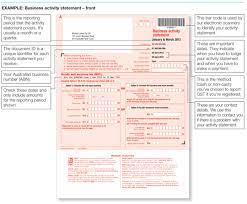

For those who lodge a paper (non-electronic) quarterly BAS or IAS, your March quarter activity statement is due to be lodged by Monday 29th April.

Personal services entities

If you have a personal services entity (you will know if this relates to you as we will have discussed this with you many times over the years), your entity will be required to pay at least 80% of its income to you as salary/wage and remit the tax thereon within this BAS.

Lodgement tip

Please note that lodgement of an activity statement (even if it is nil statement) and payment are two separate requirements. Late lodgement attracts a minimum non-deductible fine of $210 for every 28 days that a form is lodged late whereas as late payment results in an interest levy. More importantly, BAS’s and SG super which is not reported and remains unpaid after 3 months becomes a personal debt of directors (please refer to the September 2012 edition of Tips and Traps for further details on the Directors Penalty Notices system) – and the ATO are actively issuing DPN notices. That said, the ATO are agreeable to entering into payment arrangements.

STP reminder

And a quick reminder about Single Touch Payroll (STP). STP will be mandatory for all employers from July 2019. You will shortly receive an introductory letter which will be followed by a series or reminders and steps to be implemented before 30th June.

PAYG Instalments options

PAYG Instalments are income tax payments paid during the year by companies, super funds and individuals. In respect of individuals, it is levied on income not taxed upon receipt with common examples being interest, dividends and trust distributions. It is not assessed on wages or capital gains. With the September BAS being the first one for the year, one can choose how to calculate your PAYG Instalments.

We usually prefer that clients use the instalment amount method. In the majority of cases, it will not result in an over-payment that can so often arise under the instalment rate method.

In some cases though, the % rate method may enable one to pay a lesser amount. If the instalment income is nil or negligible in the first couple of quarters or much less than the year before, then no or little tax will be paid. A significant payment will only be required at such time as income is received.

It is critical with PAYG Instalments (and indeed GST Instalments) that any downwards or indeed upwards variation be made cautiously. If a variation results in the instalments paid being 15% less than the actual liability then the ATO will issue a fine.

Please do not hesitate to call us should you wish to discuss your own situation.

At MRS, we will spend today planning for your success tomorrow.

GST options

With the Sep 2017 BAS comes options as to how you can calculate GST. So what are these GST options?

Even with the introduction of the “Simpler BAS” there remain three ways to calculate and report GST.

We recommend most business clients select Option 3 (GST Instalments). Option 3 (which is only offered to small businesses who lodge quarterly BAS’s and who have turnover of less than $10,000,000) is the best for most clients as:-

- It reduces our fees by our not having to prepare BAS’s or amend those prepared by clients (at the risk of being misunderstood, there are matters that only come to light when preparing annual financial statements and which require past BAS’s to be amended).

- One doesn’t have to amend BAS’s for where a tax invoice is not held by the time a BAS is lodged.

- If profits are increasing, then one’s GST net liability will also be increasing. The instalment will represent an under payment as the ATO advised instalment is based off the prior year’s lodged activity statements. In most cases, the shortfall is not payable until May of the following year so one receives an interest free loan from the ATO to pay any GST shortfall.

- If the instalment is too high, then they can be varied downwards (but best left until at least the second and preferably the third or fourth quarter when the year’s position becomes clearer).

Please contact us if the ATO have marked on your BAS that Option 3 is not available. This is often simply an ATO error and one that we can easily have rectified.

If you adopt Option 3 , then the ATO will issue you with an Annual GST Return after the end of the financial year. This form is completed by netting off the actual liability against the instalments paid. The form is required to be lodged by the time the Tax Return is lodged and by which time a shortfall is to be paid or a refund will be generated.

At MRS, we will spend today planning for your success tomorrow.

June quarter deadlines

There are a number of upcoming June quarter deadlines.

For those of you who are employers, Friday 28th July is the end date for satisfying your SG super obligation for the June 2017 quarter. Late payments will attract substantial interest and penalties which effectively doubles or triples the cost. Even if your cash flow is tight, this commitment should be paid before anything else.

The final day for payments and reporting of Victorian Pay-roll Tax is Friday 21st July.

For those who lodge a quarterly BAS or IAS, your June quarter activity statement is due to be lodged by Friday 28th July (but 11th August for activity statements if you have registered your business as a user of the Taxpayer Portal and are not paying only fixed $ instalments).

Please note that lodgement of an activity statement (even if it is nil statement) and payment are two separate requirements. Late lodgement attracts a minimum non-deductible fine of $180 for every 28 days that a form is lodged late whereas as late payment results in an interest levy (which is often remitted). A fine is not tax deductible, interest is. Not that we encourage it, but should you not be able to pay an activity statement in full, do not defer lodgement as the possible fines are significant. The ATO will of course in time identify that an activity statement liability has not been paid and follow it up; but by this time though the liability should be paid in full anyway and at worst, incur a deductible interest charge far less than any non-lodgement penalty.

Please be mindful that the ATO now reports unpaid business tax liabilities of more than $10,000 not subject to a payment arrangement directly to credit reporting agencies. Please refer to our blog from 12th June 2017 for further information.

I remind you that under the Director Penalty Regime which came into effect in July 2012, PAYG Withholding (WH) and SGC super which remains unreported and unpaid after 3 months now results in the unpaid amounts becoming a personal liability of any directors. Placing a company into liquidation doesn’t avoid or extinguish this liability. For further information, please refer to our September 2012 Tips and Traps newsletter.

Please contact us should you have any queries or require assistance.

For other key dates, please click on the Key Dates button on our firm app. If you haven’t done so already, you can download it from either Google Play or the Apple App stores. Simply type in Maggs Reid Stewart at either site and we should come up first with our logo prominent. You will also find a heap of useful tools and calculators in our app.

At MRS, we will spend today planning for your success tomorrow.